23 October 2014

Introduction

For commercial reasons Chatham Rock Phosphate has refrained from publishing detailed information of both its marketing strategy and other sensitive aspects of its business plan including prospective future profitability. However, in the context of the Environmental Protection Authority hearing of our Marine Consent application it is now necessary to do so in view of:

1. Uninformed comment from opponents and their economists about the project’s economic viability;

2. The increasing need to fully inform the decision-making committee (DMC) of the business logic that underlies this initiative and the flow-on economic benefits accruing to New Zealand.

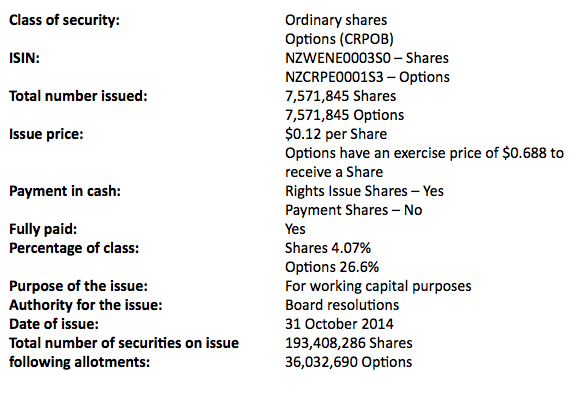

As these matters are arising through the hearing process it is necessary to ensure that there is a fully and properly informed market for Chatham Rock Phosphate’s shares.

Marketing Strategy

In recent years Chatham’s marketing vice president Najib Moutia has undertaken extensive market research and sales development in international and local rock phosphate markets. This research has involved contact on a regular basis with fertiliser manufacturers in many countries.

Relevant factors affecting the demand for CRP rock phosphate include a range of product characteristics including but not limited to:

· the level of contained phosphorus

· the normal levels of iron and aluminium

· calcium carbonate levels

· very low cadmium levels

· ease of handling, including suitable angle of repose and low dust levels

· and the opportunity to certify the rock as organic.

Due to these product characteristics CRP rock phosphate can be used to make either medium or high grade superphosphate, direct application fertiliser, or even dicalcic phosphate.

The dialogue with potential buyers has led to the development of sales projections by product use and by country for eight countries. The location of target countries is partially governed by freight costs and hence they are mainly in Australasia and Asia-Pacific. Sales or supply agreements have not been entered into however the high degree of interest received has given CRP confidence that such agreements can be secured following the project being fully permitted.

In each case product specific sales projections and expected selling prices have been developed based on intra-country market needs.

In summary approximately 1.15 million tonnes are expected to be exported annually and 350,000 tonnes used within New Zealand. Of this two thirds of the total are expected to be used to make single super phosphate and one third will be sold for direct application use, in six countries. Notably, rock sold for direct application use sells at a substantial premium in some markets so the product mix will be focussed towards maximising direct application use.

We believe the market for direct application rock phosphate in New Zealand is 100,000 to 200,000 tonnes a year with potential for significant expansion, given

· this product has not been readily available from a local source

· there is a desire or likely requirement to reduce leaching run-off effects, and

· the ideal characteristics of our product for high country use and for maintenance in dairy farm application.

We have commissioned updated pot trials to validate the work done in earlier years proving the strong performance of our product on New Zealand soils. We are also evaluating the market potential for RPR on home garden use in New Zealand and internationally.

Indicative Project Economics & Cost Structures

CRP proposes to use one vessel to mine 30km² of seabed per annum, consisting of about three 2km wide by 5km long mining blocks. It is expected that the mining cycle will consist of approximately one day’s travel to the mining block, four to five days mining, one day transit to port and three days unloading. Allowance is made within this cycle to accommodate weather delays and equipment servicing. This mining plan is intended to satisfy an annual production target of 1.5 million tonnes of phosphate.

Based on the projected uses above and taking into account currently prevailing contract prices (not merely the World Bank-quoted spot price, which is simply a reference point) applicable to our product range we expect an average revenue per tonne of USD 125 (NZD 158) yielding annual project revenues of USD 187.5 million (NZD 237 million). These revenues are net of export freight costs.

After deducting expected contract dredging costs, incoming port charges, environmental monitoring costs, community contributions, biodiversity offset costs and business overheads, the annual profit before royalties is presently estimated to be USD 54 million (NZD 68 million).

From this estimated profit Chatham is presently estimated to annually pay USD 5.4 million (NZD 6.8 m) in royalties and USD 13.6 million (NZD 17.2m) in income tax.

One of the key financial strengths of the project is the fact that the cost of transport of imported rock phosphate to New Zealand is about equivalent to Chatham’s current estimated mining costs, which gives the project a significant financial advantage.

CRP commissioned RSC Consulting Ltd (“RSC”) to undertake an independent Mineral Resource estimation study on its project earlier this year and prepare a report to comply with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, 2012 Edition (“Jorc Report”). The JORC Report considered that the project area contains a total of 80 million m³ of phosphate at an average grade of 290 kg/m³, classified as an Inferred Mineral Resource at a cut-off grade of 100 kg/m³ for a total contained 23.4 million tonnes of phosphorites.

This Inferred Mineral Resource is consistent with an expected project life of 15 years. Chatham Rock Phosphate will, based on our existing assumptions, earn tax paid profits of USD 525 million (NZD 663 million), pay royalties of USD 81 million (NZD 102 million), and pay income tax of USD 204 million (NZD 258 million) during this period.

Other Economic Benefits

CRP will pay incoming port charges to the port where the operations and product stockpiles will be based. These are not yet quantified but will be (at the least) several million dollars a year.

Further, a number of local employment opportunities will be associated with this project, including:

1. Port support services relating to product handling

2. Overseas phosphate export vessels provisioning support services ( 30+ ships)

3. Survey vessel services

4. Portside engineering services

5. Jobs on the mining vessel

6. Other jobs relating to environmental monitoring services

7. Maritime training opportunities

8. Ongoing scientific research and data gathering

9. Mining vessel provisioning and bunkering

10. Jobs arising from increasing farming outputs where CRP rock is used on marginal land

Conclusion

In summary, Chatham’s project financials offer significant economic benefits for New Zealand and the potential for attractive profitability for investors. In addition it offers new environmental benefits for New Zealand’s farming industry, in terms of using a low cadmium, low carbon footprint, low run off, potentially organic product. This project will create a new industry with strong ties to agriculture, our most important export earner.

Chatham Rock Phosphate product will enhance New Zealand’s security of supply, reducing our exposure to politically risky sources of a critical input to this country’s biggest industry.

Chris Castle, Managing Director +64 21 55 81 85 or chris@crpl.co.nz

Warning - Forward Looking Statements

This release contains forward looking statements. Forward-looking statements and information are not historical facts, are made as of the date of this release, and include, but are not limited to, statements regarding discussions of future plans, guidance, projections, objectives, estimates and forecasts and statements as to CRP's expectations with respect to, among other things, mineral properties and the matters described in this release.

These forward looking statements involve numerous risks and uncertainties and actual results may vary. Important factors that may cause actual results to vary include without limitation, the timing and receipt of certain approvals, changes in commodity prices, changes in interest and currency exchange rates, risks inherent in exploration results, timing and success, inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral reserves and resources), changes in development or mining plans due to changes in logistical, technical or other factors, unanticipated operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications, cost escalation, unavailability of materials, equipment and third party contractors, delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters), political risk, social unrest, and changes in general economic conditions or conditions in the financial markets.

+64 21 5581985

+64 21 5581985 chris@crpl.co.nz

chris@crpl.co.nz PhosphateKing

PhosphateKing