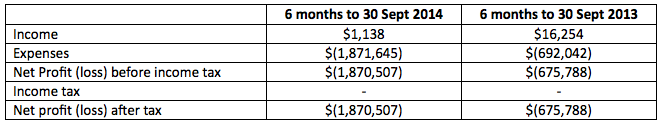

The increased deficit for the six months to 30 September 2014 is mainly due to costs related to the AIM listing process that commenced during the period.

Operations Highlights

It’s been an incredibly demanding, satisfying and yet at times frustrating six months but as we approach the end of 2014, we can look back on having achieved some significant milestones. Most satisfying and humbling is the continued tangible financial support shareholders have shown for this project. Since August, shareholders have contributed more than $6 million towards our goal of a marine consent, bringing the total raised over the past four years to more than $33 million.

Naturally, we all hope we will get a great return on our investment as we advance this project towards mining; but the feedback from shareholders (both in New Zealand and overseas) is they also want this project to succeed for New Zealand’s agricultural and environmental benefit, and for it to be the first successful seabed mining project in the world.

We are all pioneers in a new industry – and your project team’s focus is to ensure we will continue to be well prepared, well-resourced and expertly managed. The reason we receive such support from both shareholders and our many other well-wishers is we have a strong group of leading experts in their respective fields, who have designed such a powerful proposition that they have made the job of sourcing the necessary funding comparatively easy.

The hearing

We have now (we hope) concluded the 26 days of hearings over seven weeks. The Decision-Making Committee will formally close the hearing once they are confident they have all the necessary information to make a decision. Chair Neil Walter indicated that the assessment of completeness for the decision would largely focus on our comprehensive draft conditions.

We’re still hoping for a pre-Christmas decision. Whatever the time frame, the latest tranche of money raised – thank you for your enthusiastic support - gives us enough to keep the wheels turning in the New Year if we need to wait a bit longer.

The Committee will consider four decision options – from a full grant for what we applied, to a decline. We told the committee there was ample evidence for full approval to mine for up to 35 years across the marine consent area. We said the option of trial mining is not financially feasible because of how much money we have invested already and the further capital involved in building a suitable vessel.

Asked whether an option to grant consent for the smaller, already granted mining permit area for 15 years was workable, we said it was not our preference, because of future consenting costs and process. We noted that this option would involve legal and practical issues such as undertaking monitoring in a wider area, and providing for mining exclusion zones.

We’ve provided shareholders with regular updates on the hearing process, including our views about its shortcomings – particularly relating to the staff reports. Overall we think the process works, though it is expensive, time consuming and has imperfections.

We recognise we are only the second seabed mining application using the new Exclusive Economic Zone law, so the process is still being bedded in. For example, we think the Crown played a useful role in our hearing process with its submission, but were disappointed – given what it calls its growth agenda (including exports) - it did not advance the wider economic impacts of the project, and simply focused on conservation issues.

In summary, our key messages are:

- our proposal involves very limited environmental risks in a small area;

- it has economic, strategic and environmental benefits;

- it will not harm any other industry or resource user in New Zealand's economy;

- the few material environmental risks can be managed by conditions;

- our proposed impacts are minuscule compared with those of fishing, which should be taken into account in considering our application;

- our models are based on significant data, which can and will be further validated; and

- Benthic Protection Areas should be replaced by more refined protected areas.

In summary, the project offers new environmental benefits for New Zealand’s farming industry, by using a low cadmium, low carbon footprint, low run-off, potentially organic product. It will create a new industry with strong ties to agriculture - New Zealand’s most important export earner. CRP’s product will enhance security of supply and reduce exposure to politically risky sources of a critical input to New Zealand’s biggest industry.

Financing

While the primary focus of the period under review has been the marine consent process, the companion to that has been continuing to finance the costs. Consenting is an expensive process – the company’s shareholders pay for all of the relevant costs of the Environmental Protection Authority, as well as our own. In addition, your money has been invested in a range of scientific reports, witness costs and of course the cost of the legal guidance we have received.

Our best success in raising capital over the past year has come from ongoing strong support from our Kiwi shareholders, plus a small group of overseas investors – mainly from the United States and more recently from Britain and Australia – complementing the earlier investments from corporate sources such as our technical partner Boskalis and from Odyssey Marine.

We’ve had little success from our two attempts so far at a broader public offering. Perhaps it’s arguably too early in the process – certainly most institutional investors tell us to “come back when you are permitted”, even though the share price will likely be much higher when the project is “de-risked”. However, local financial markets seem to have far more appetite for raising substantial capital for early stage “tech” projects, than a proposition such as ours.

Broader financial markets are obviously much less informed than our loyal shareholders. So they are more unnerved when there is bad news. Our efforts for an Initial Public Offering and listing on the London AIM market were severely damaged by the negative decision regarding Trans Tasman Resources’ application for a marine consent.

Our decision to go to the London market was based on considerable enthusiasm for our project earlier in the year. But as most experienced investors know, markets run hot and cold – and it doesn’t take much sometimes to change sentiment.

Thus, we ultimately made the decision our AIM IPO would not fly in 2014, though we remain determined to list our shares – given their unique appeal – on an international market in 2015.

The future

While the hearing process and financing have been our main areas of focus this year, we are also working on a range of other areas. We are talking with Boskalis to advance our contract discussions and Najib Moutia continues to undertake sales development work through his amazing array of international industry contacts. We’re also conducting pot trials of our product to validate the positive findings of the extensive testing undertaken in earlier years, among other research work.

We remain very confident we have done what it takes to get environmental approval for our project. It’s been a bit like a golf tournament: we’ve done the preparation, we’ve played every shot with care and precision and the ball has generally landed where we wanted it. Ultimately we – including all our loyal shareholders – have done everything we can to win the prize.

We can’t determine the outcome – but we definitely deserve to win.

Chris Castle Robert Goodden

Managing Director Chairman

27 November 2014

+64 21 5581985

+64 21 5581985 chris@crpl.co.nz

chris@crpl.co.nz PhosphateKing

PhosphateKing