CRP features on CEO Clips airing on the Documentary Channel

/1 May 2017

Chatham Rock Phosphate features on CEO Clips airing on the Documentary Channel

CEO Clips, a series which profiles the most innovative publicly traded companies in North America, will feature Chatham Rock Phosphate on The Documentary Channel beginning May 15-28, 2017, Monday – Friday between the hours of 6am – 12am.

Our CEO Clip has been posted on Thomson Reuters Insider Network at http://reut.rs/2oBczTo, where it can be viewed by over 80,000 financial professionals.

In addition it will be posted on these financial portals: BNN.ca Finance, Thomson Reuters Insider Network, Stockhouse, YouTube, as well as on BTV/CEO Clips.

It can also be viewed online via this link:

http://www.b-tv.com/chatham-rock-phosphate-ceo-clip/ and on the home page of our website at www.rockphosphate.co.nz

For additional information contact:

Chris Castle

Chief Executive Officer

Chatham Rock Phosphate Limited

Email: chris@crpl.co.nz

Cell: +64 21 558 185

Skype: phosphateking

www.rockphosphate.co.nz

About The Documentary Channel:

“Documentary is a digital television station devoted to showing the best documentaries from Canada and around the world. With its special emphasis on feature length films, watching Documentary is like having a cinema in your own living room, showing award winning films twenty-four hours a day, seven days a week.”

About Chatham Rock Phosphate

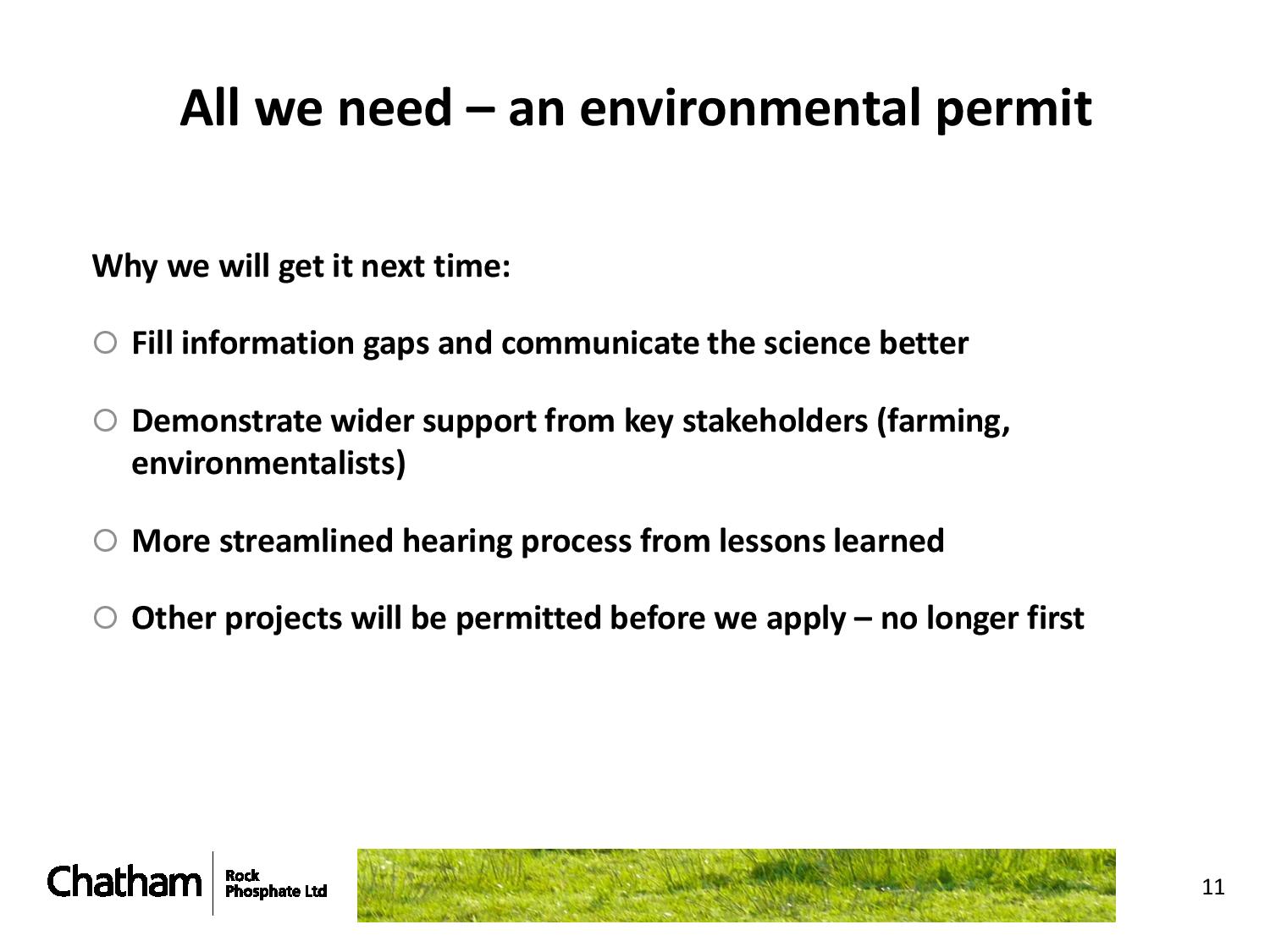

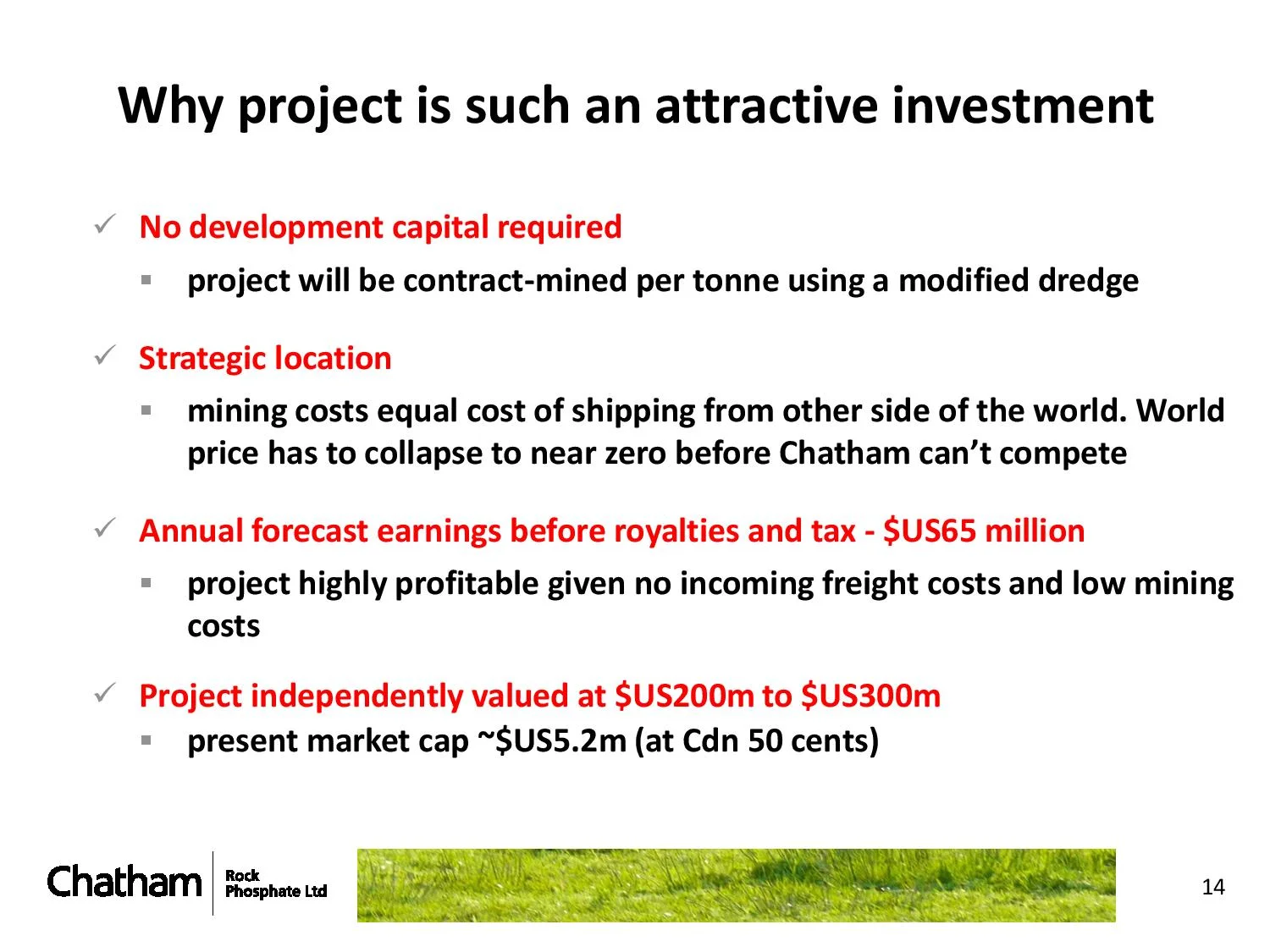

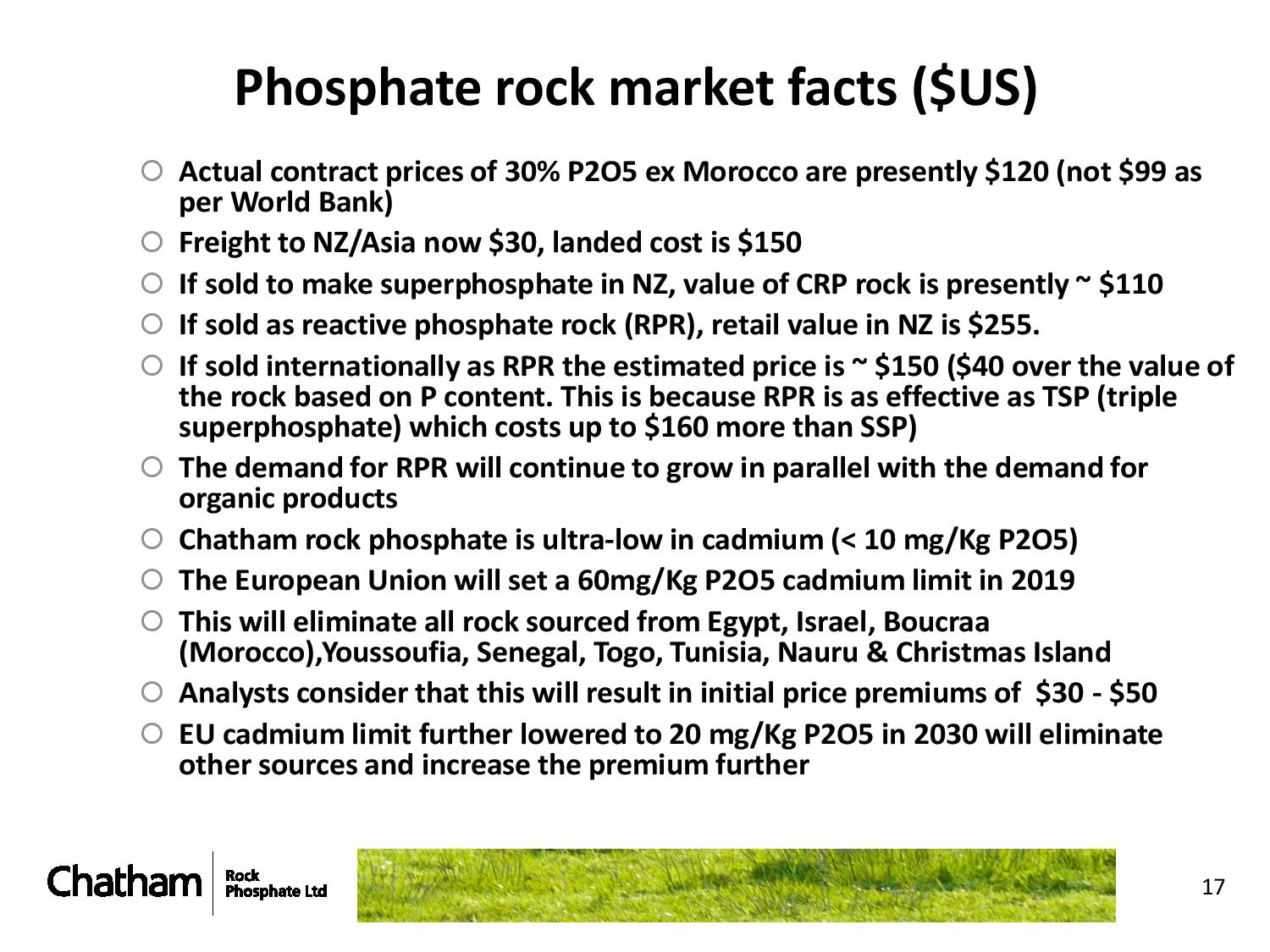

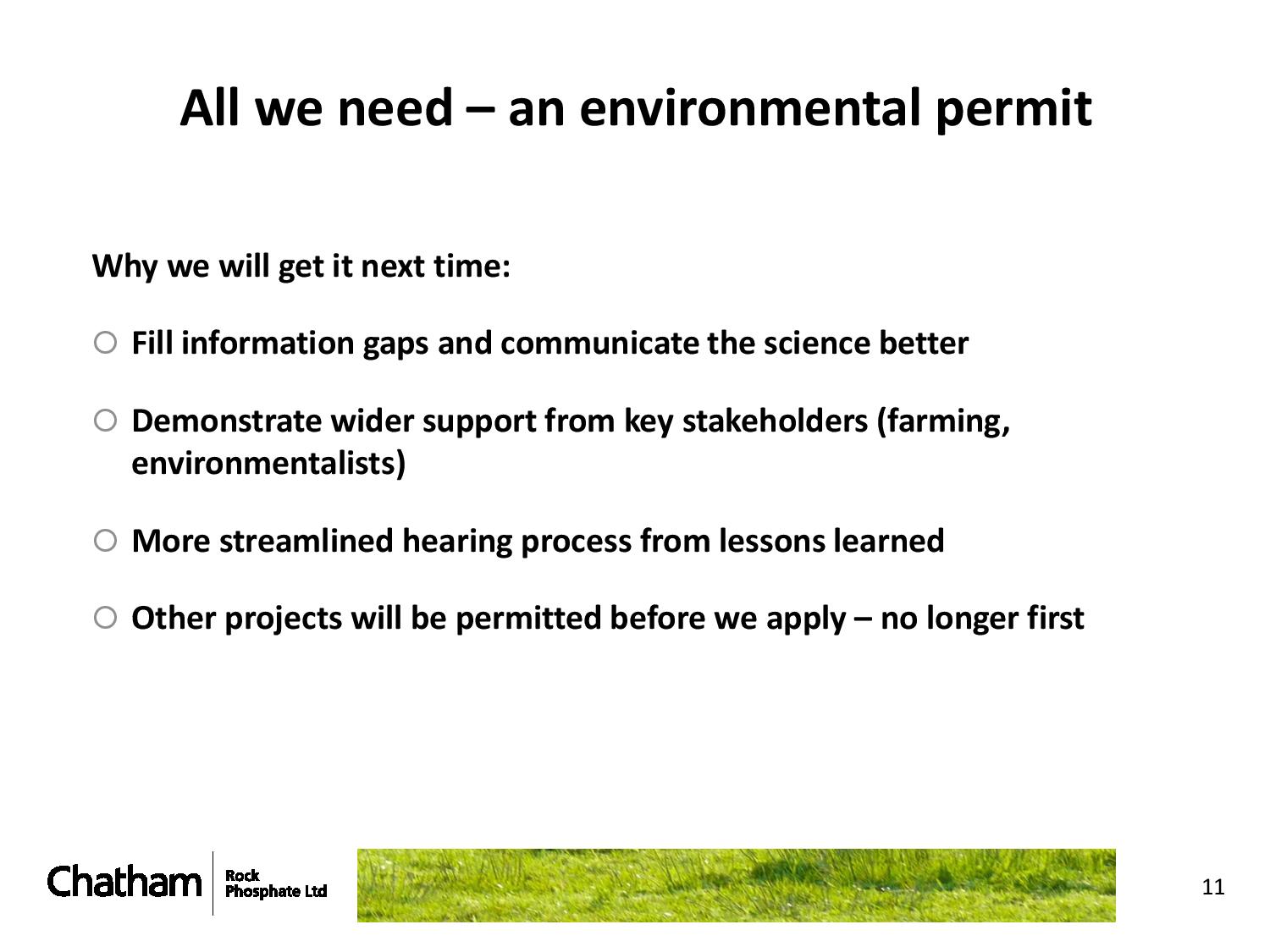

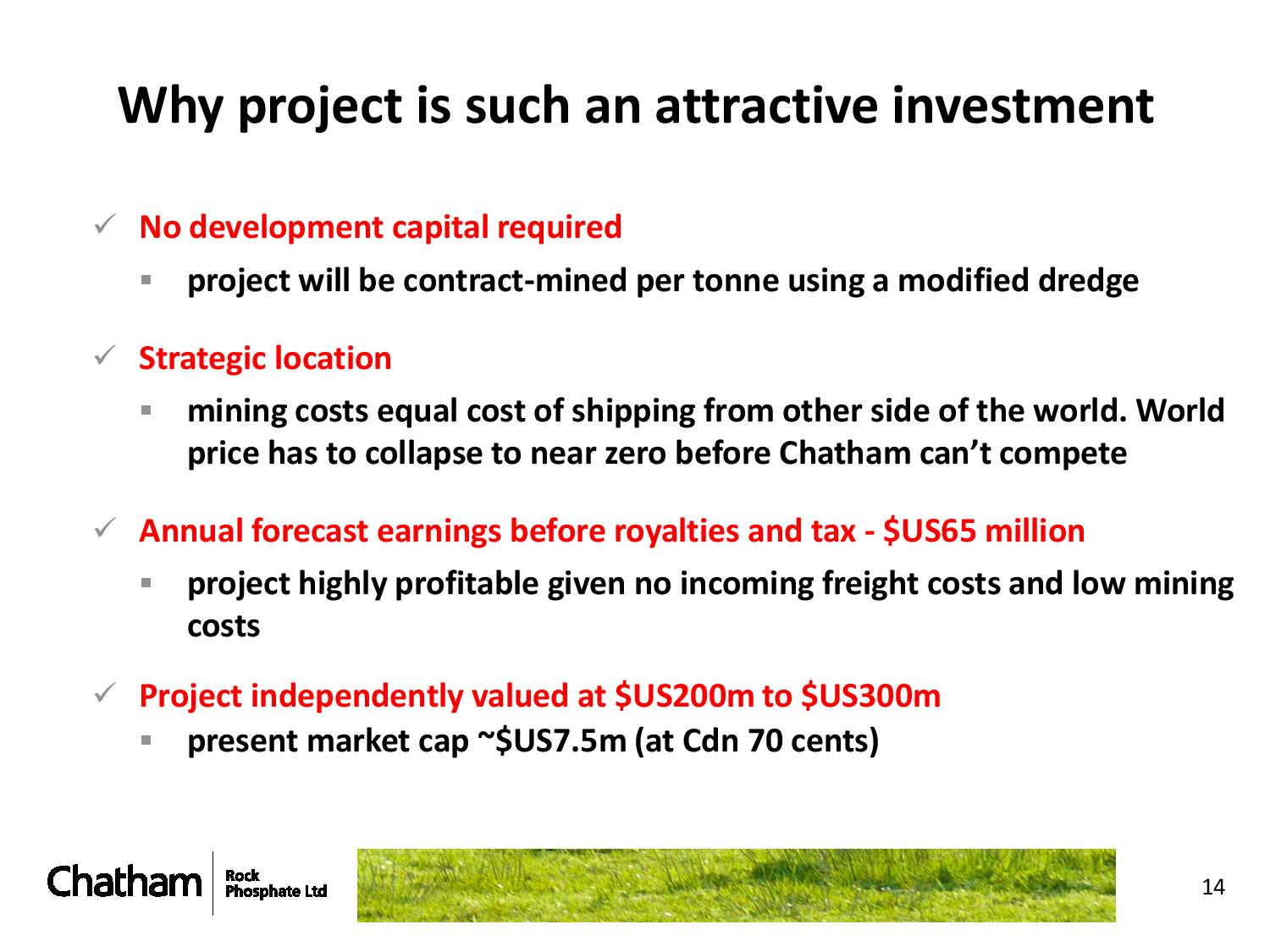

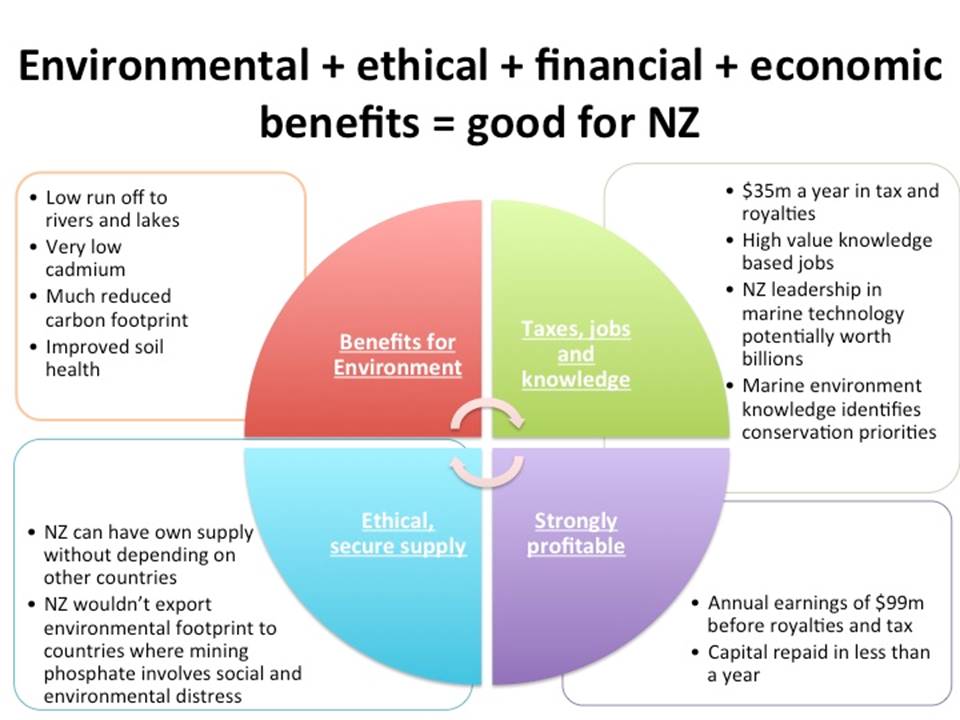

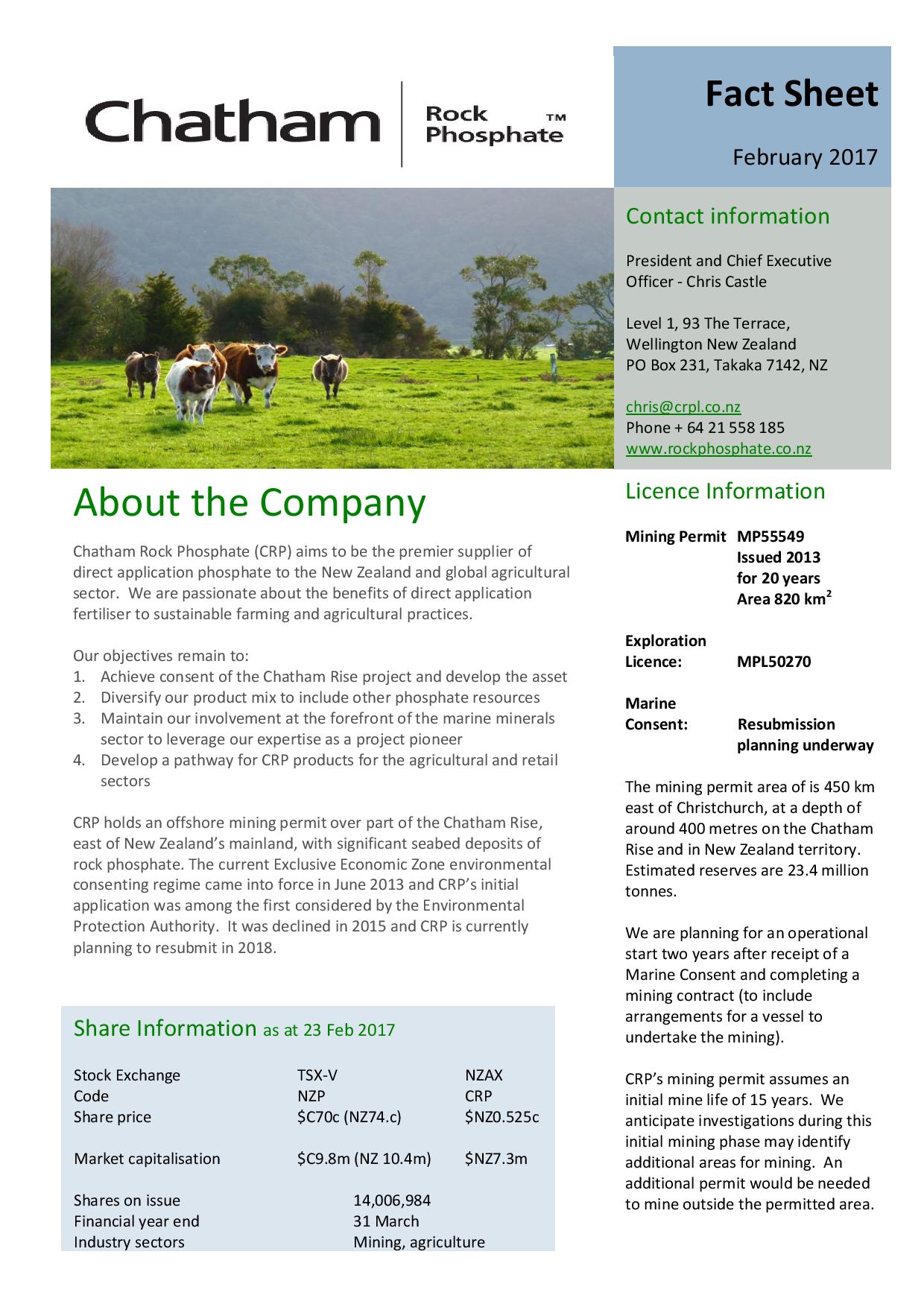

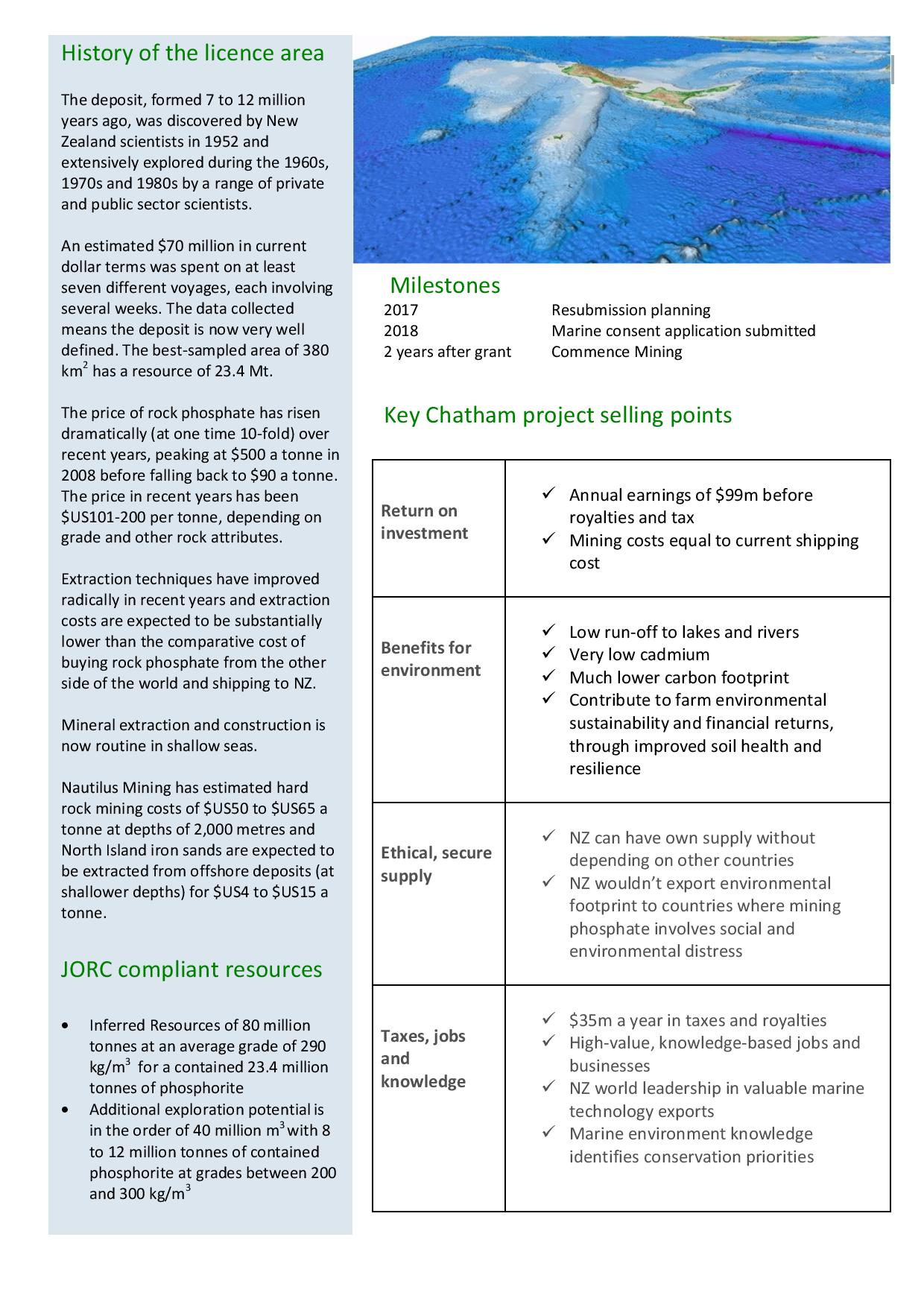

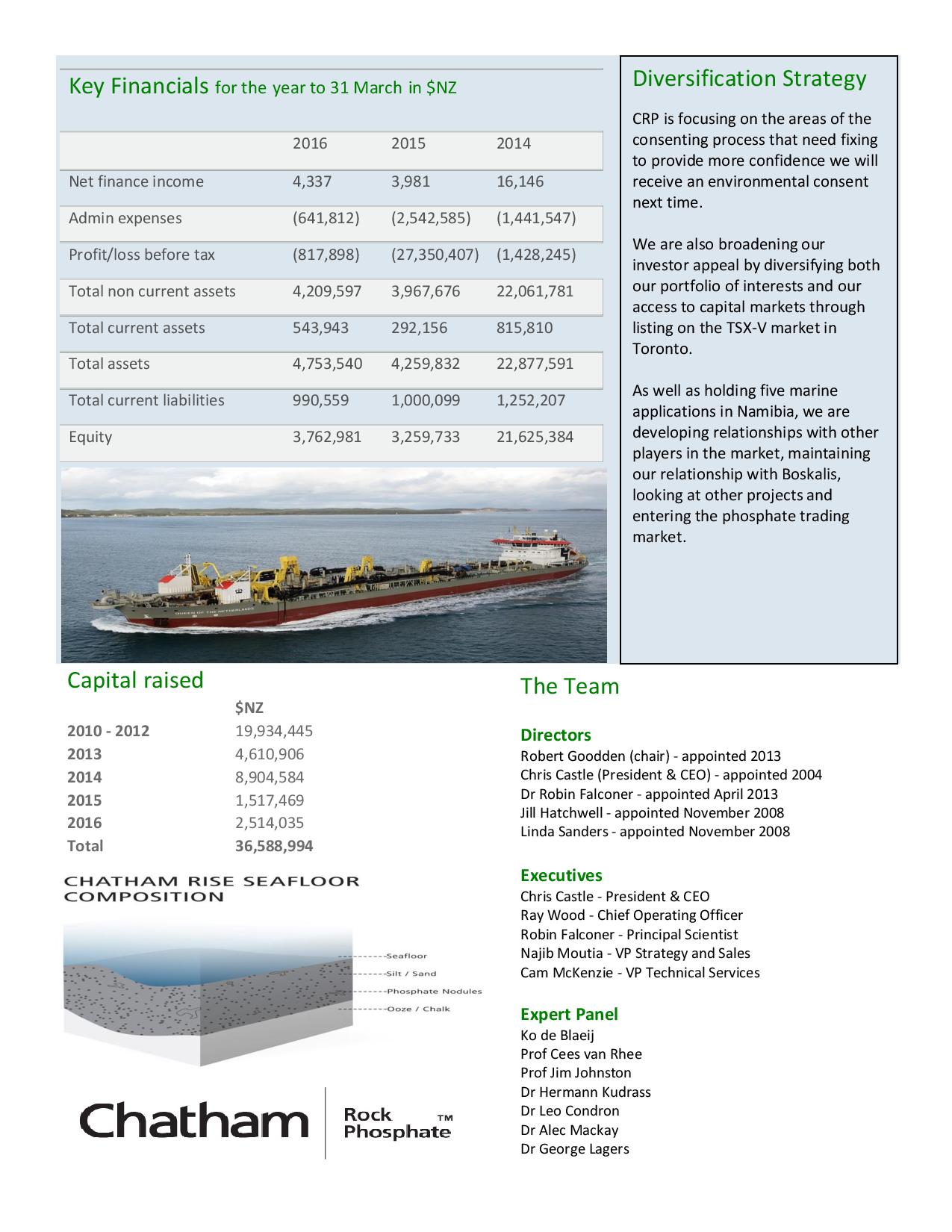

Chatham Rock Phosphate, listed on the TSX.V (ticker NZP), the NZAX (code CRP) and the Frankfurt Stock Exchange (code 3GRE), was granted a mining permit in 2013 to develop New Zealand’s only significant source of environmentally friendly pastoral phosphate fertiliser and is now preparing for a revised environmental consent application.

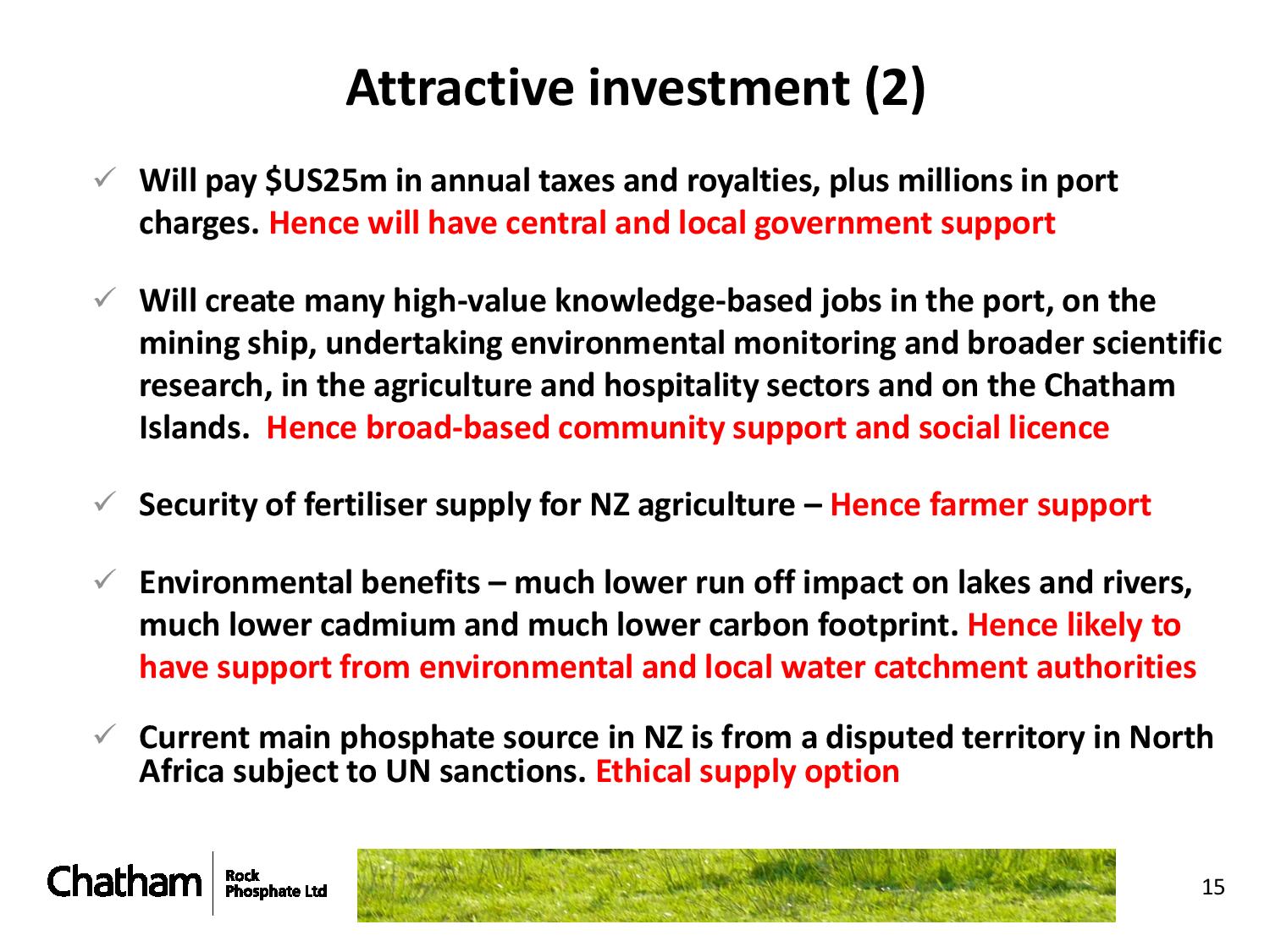

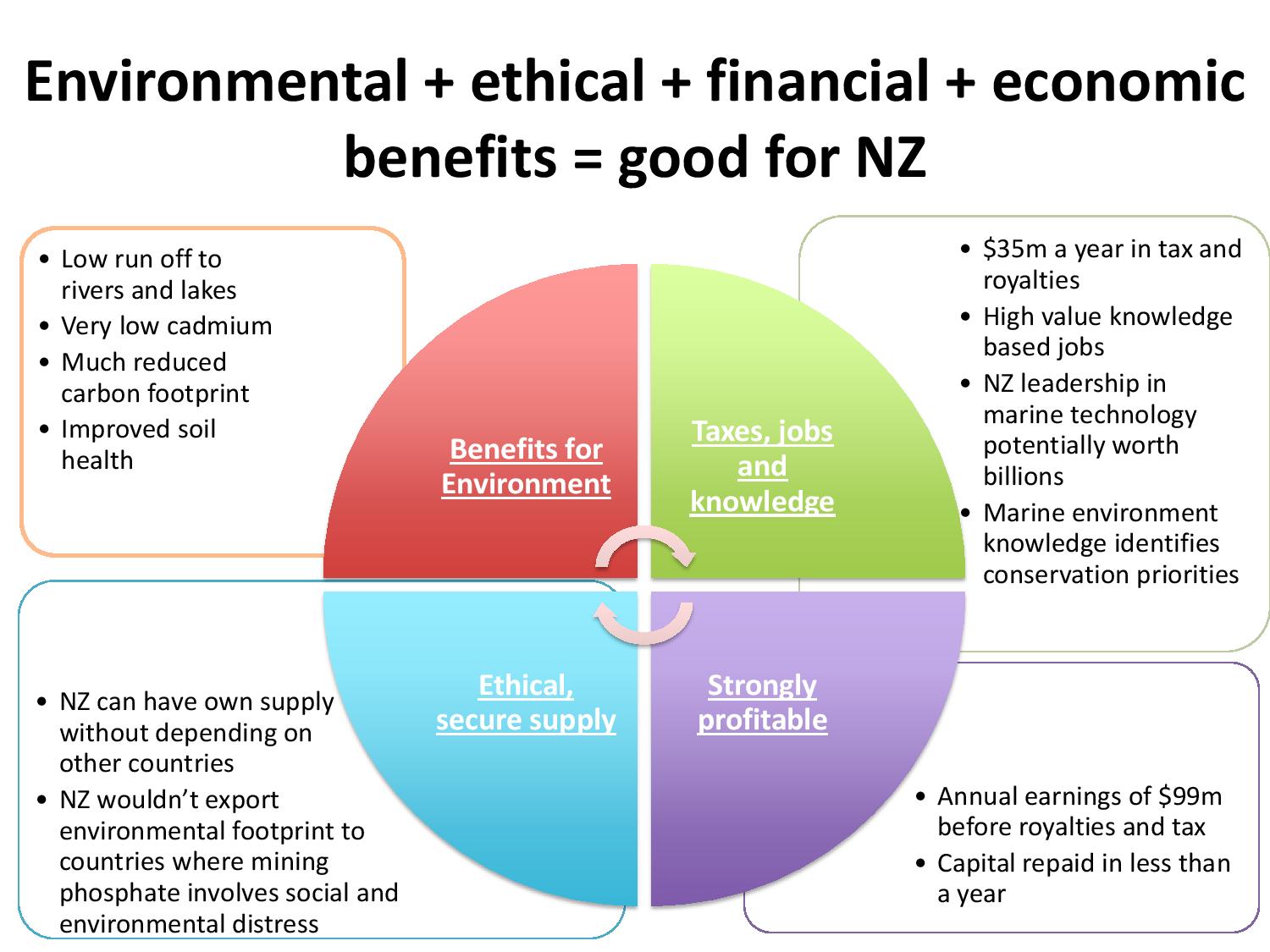

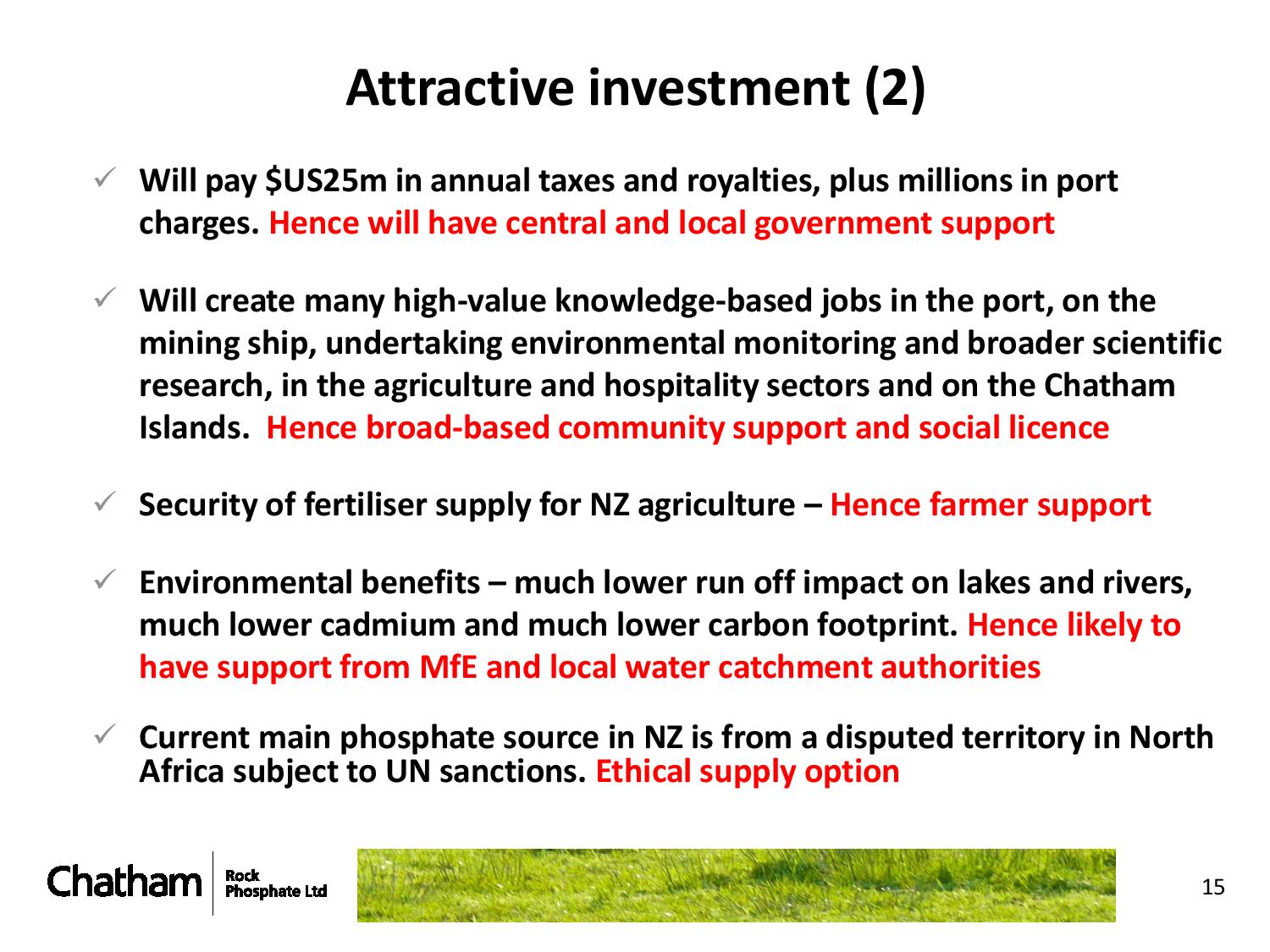

Our role as custodian of this resource is focused on delivering a secure and sustainable local supply of low-cadmium phosphate that will reduce fertiliser run-off into waterways, produce healthier soils and shrink fertiliser needs over time.

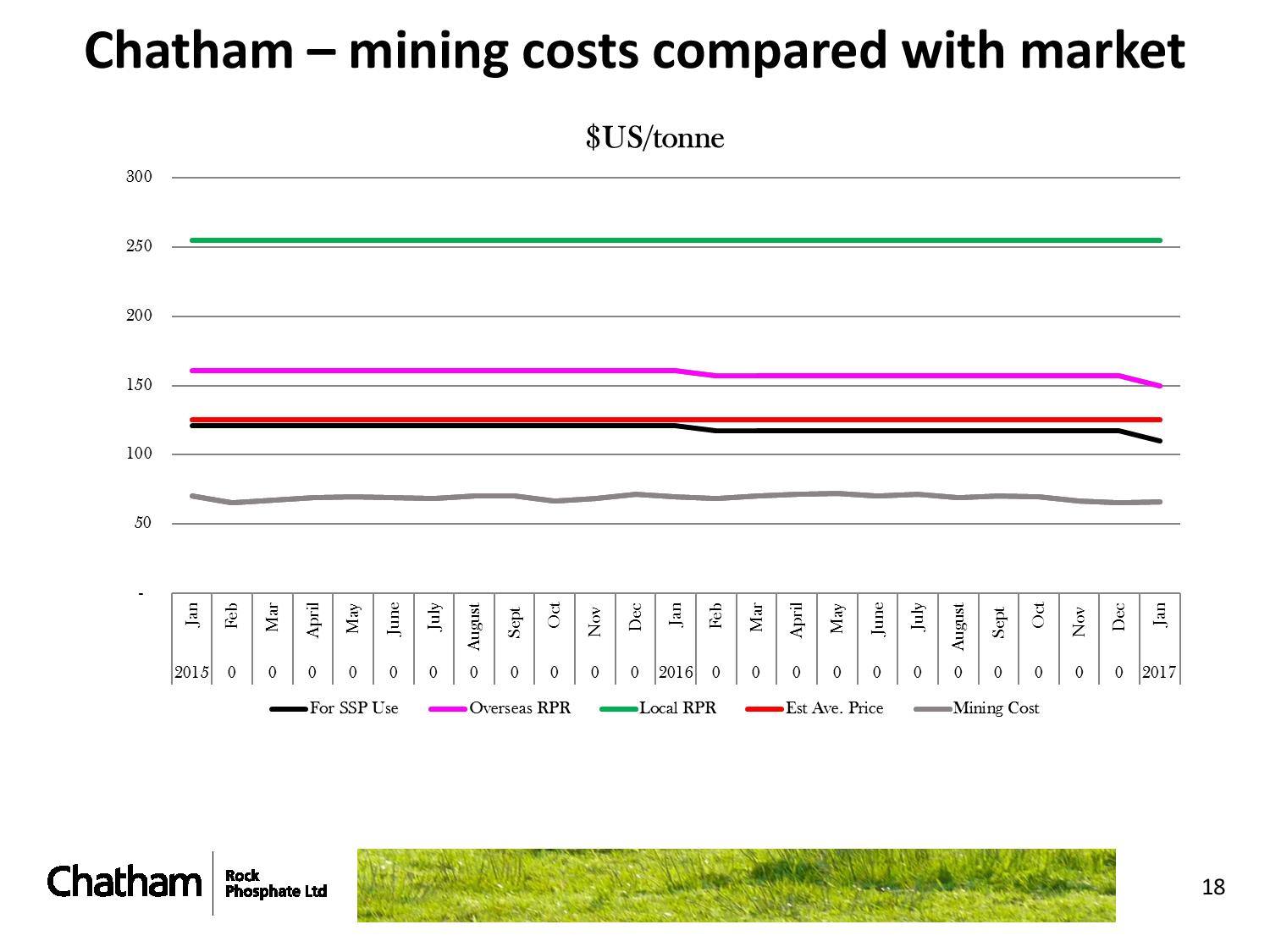

The resource has an estimated worth of $5 to $7 billion, representing one of New Zealand’s most valuable mineral assets and is of huge strategic significance because phosphate is essential to maintain New Zealand’s high agricultural productivity. Local and international investors have contributed more than $40 million to develop the project’s financial viability, environmental benefits and impacts, technical and logistical requirements, local and international product uses.

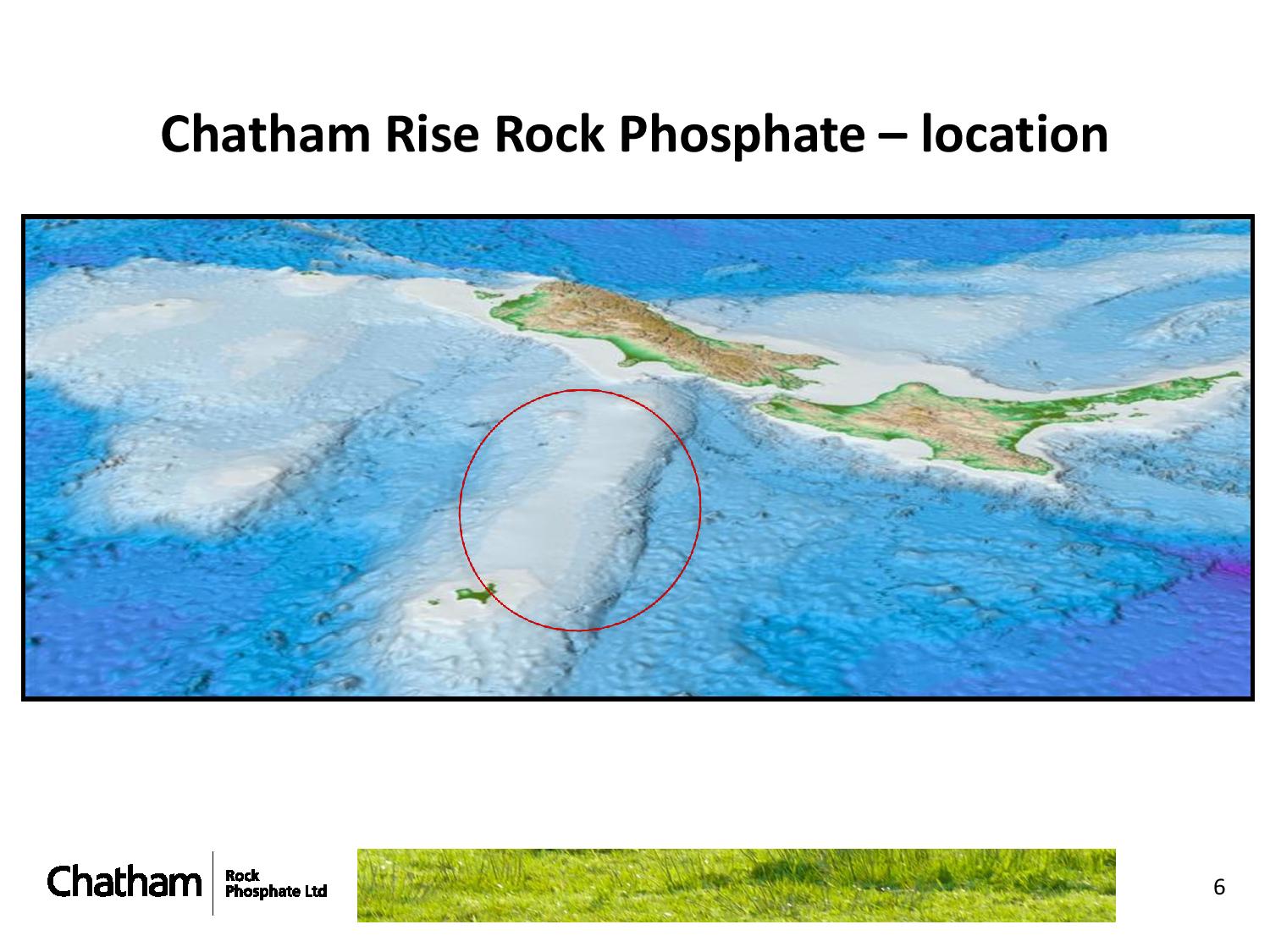

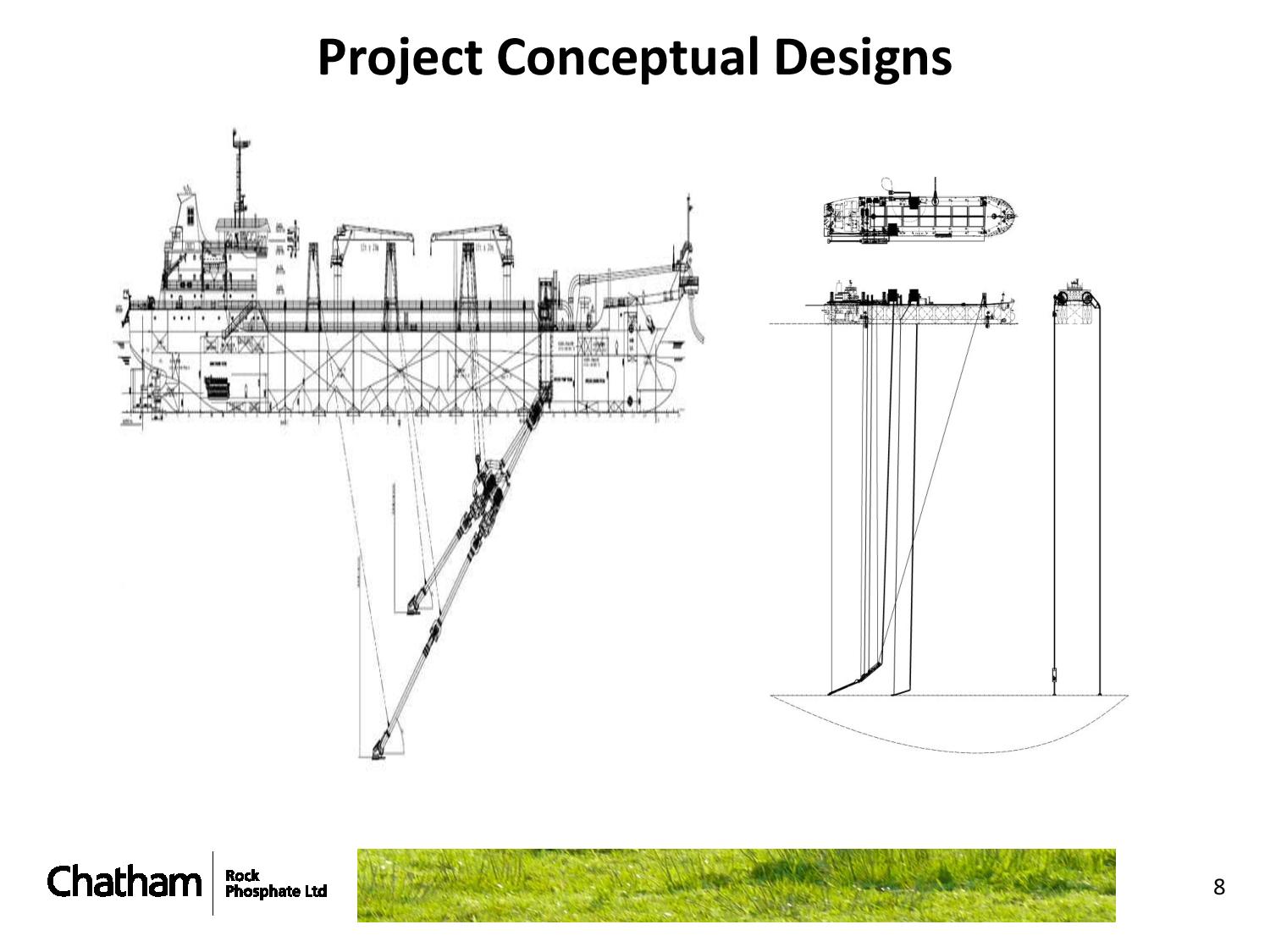

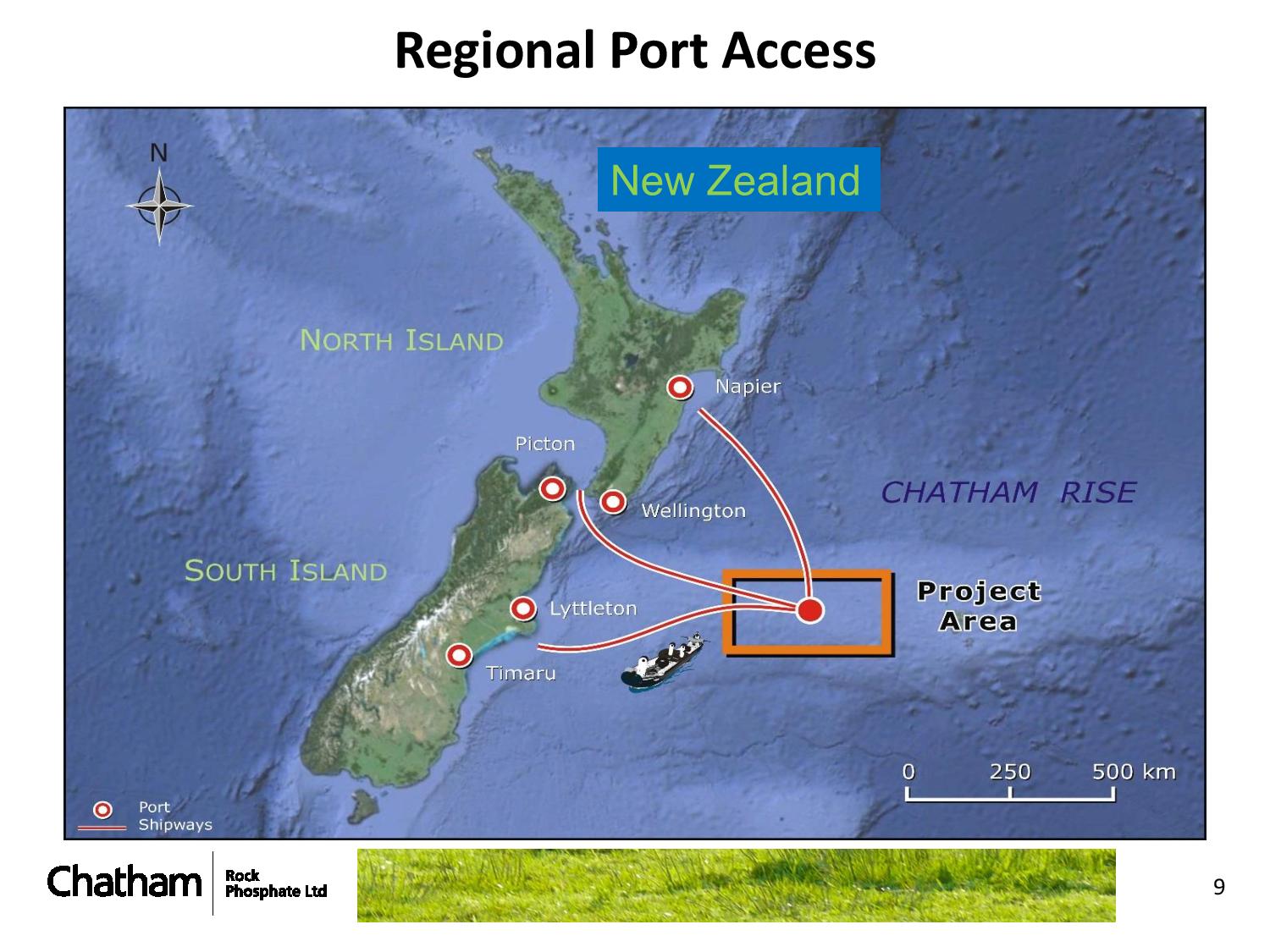

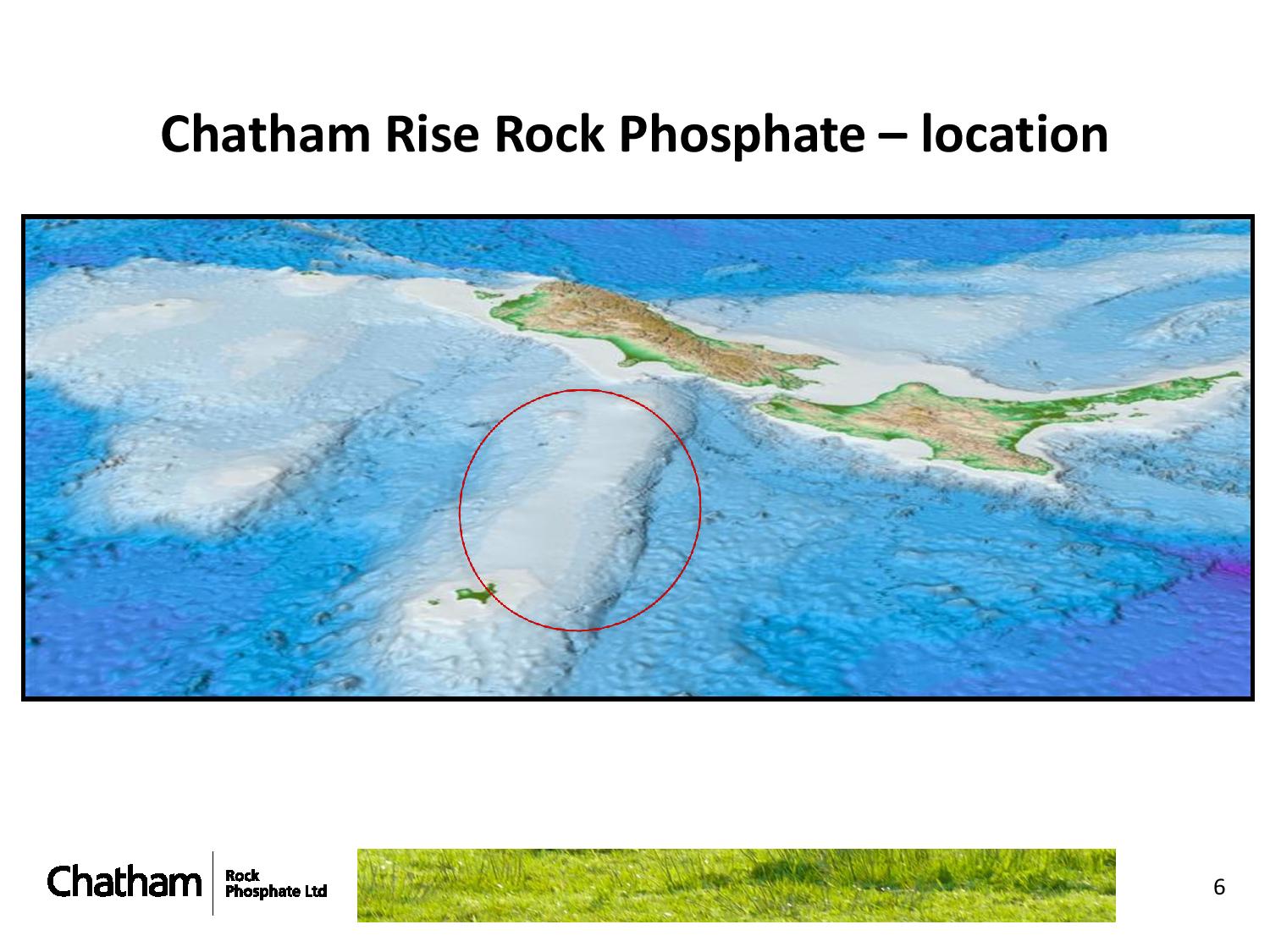

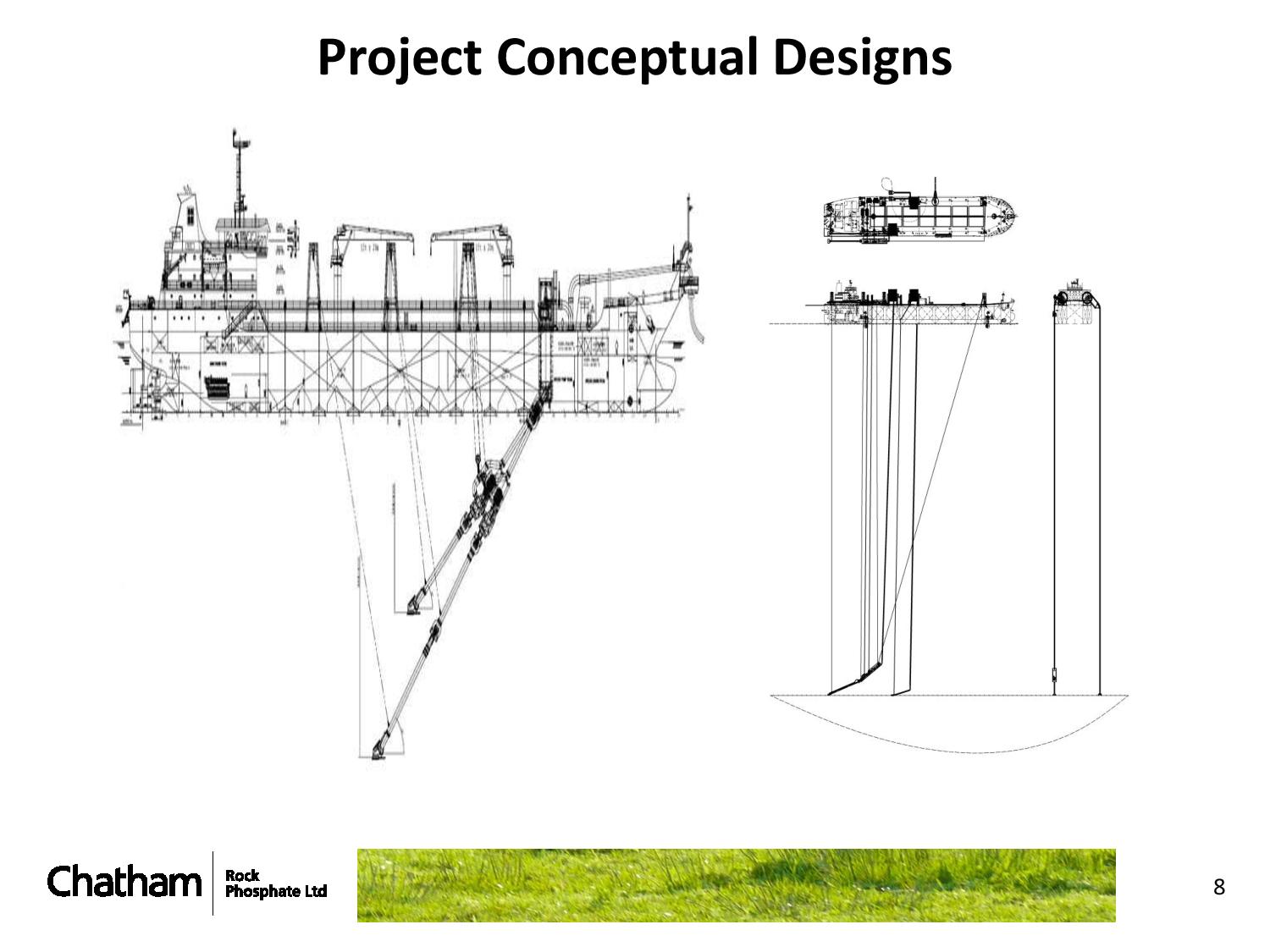

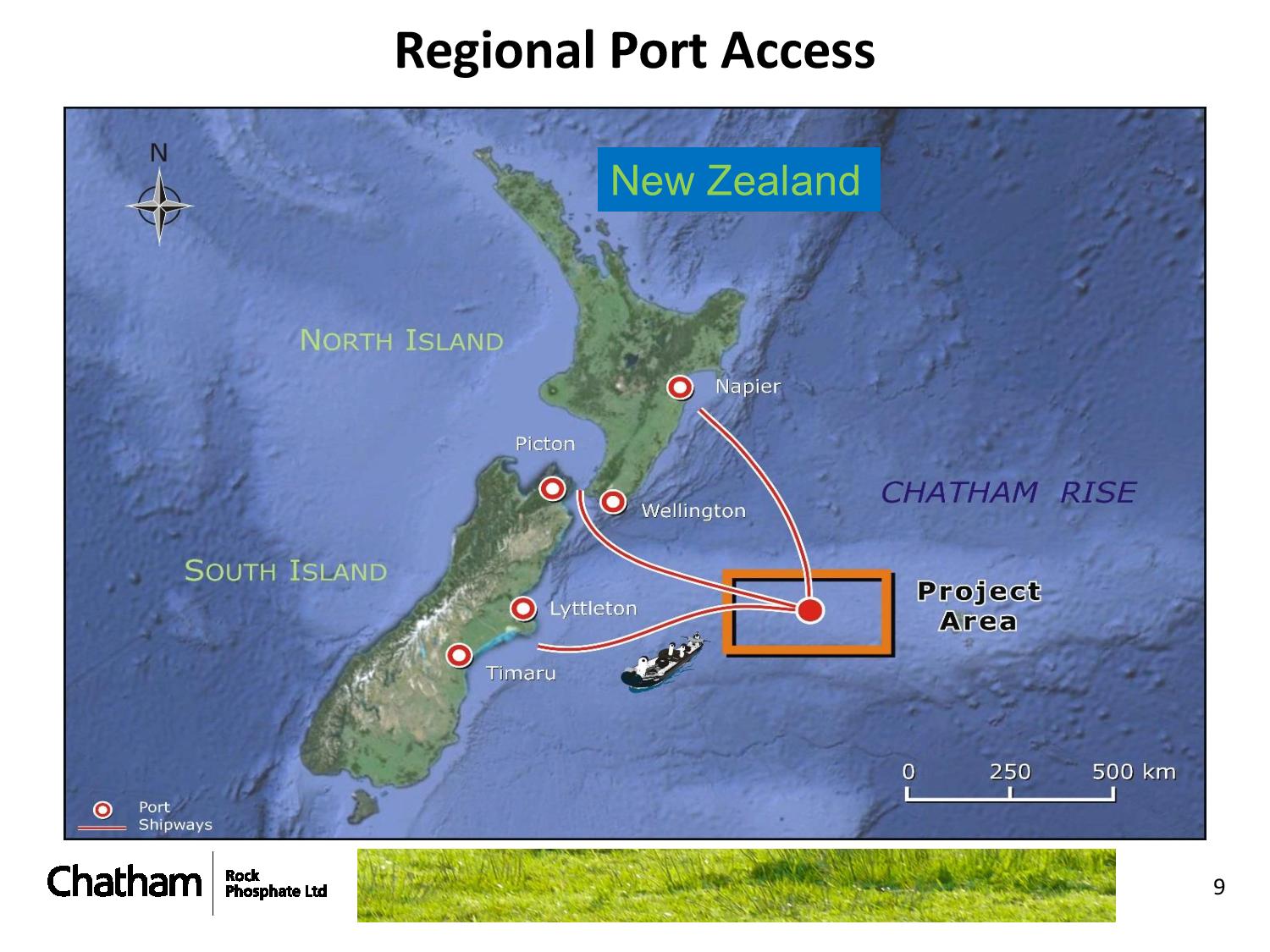

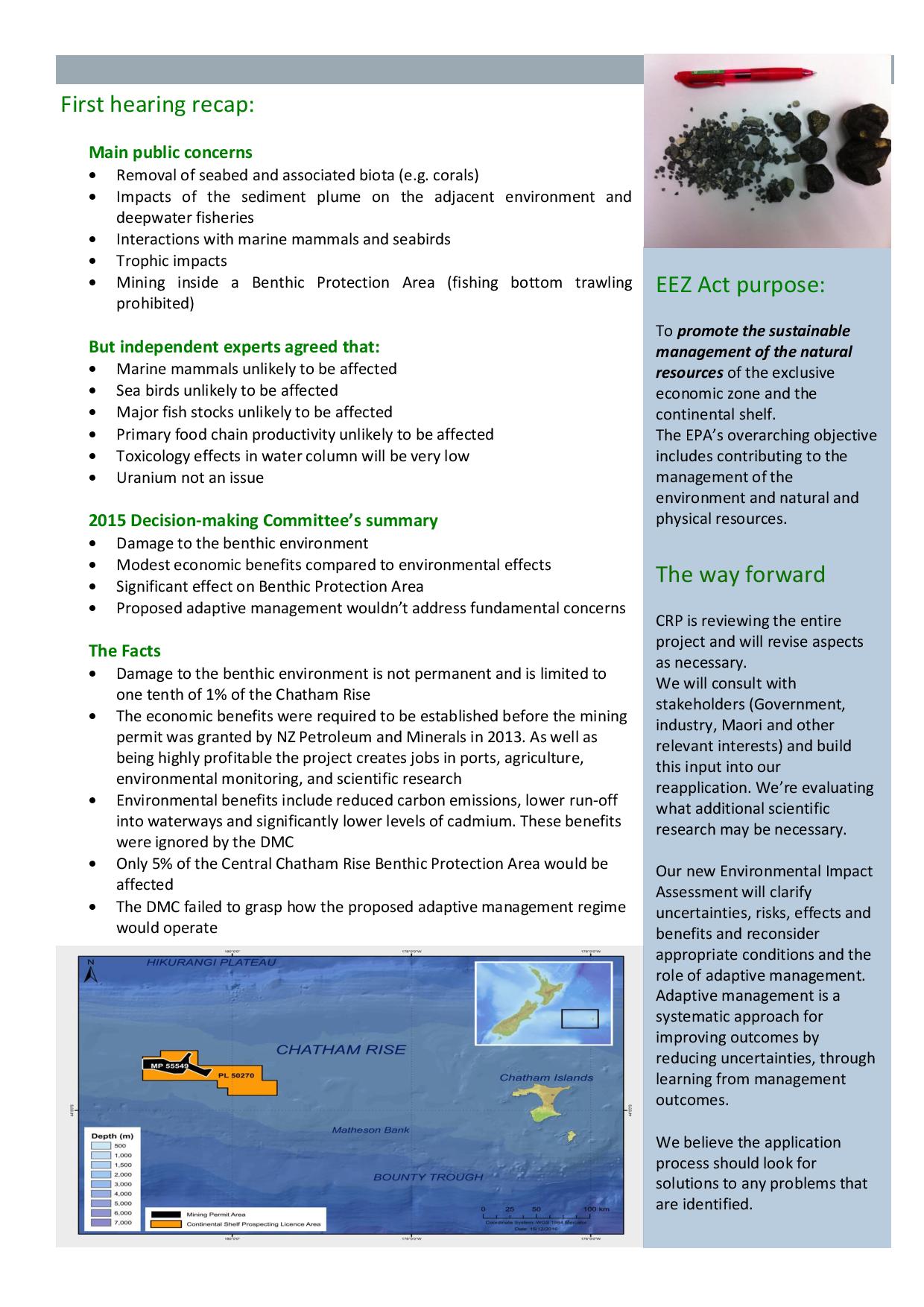

We propose to extract up to 1.5 million tonnes of phosphate nodules from the top half metre of sand on identified parts of an 820km2 area on the Chatham Rise, 450km off the east coast of New Zealand, in waters of 400m. Our environmental consenting process has established extraction would have no material impact on fishing yields or profitability, marine mammals or seabirds.

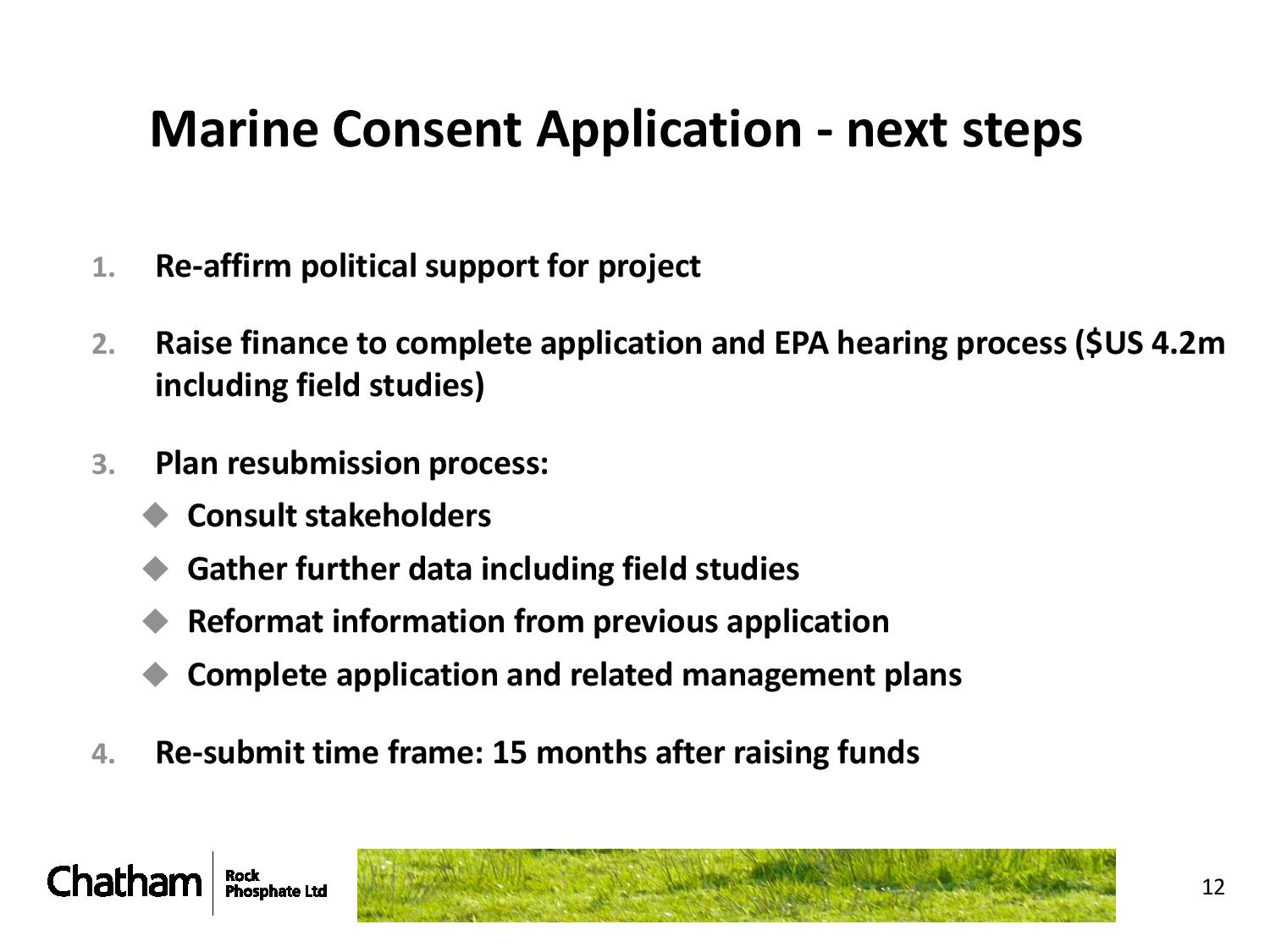

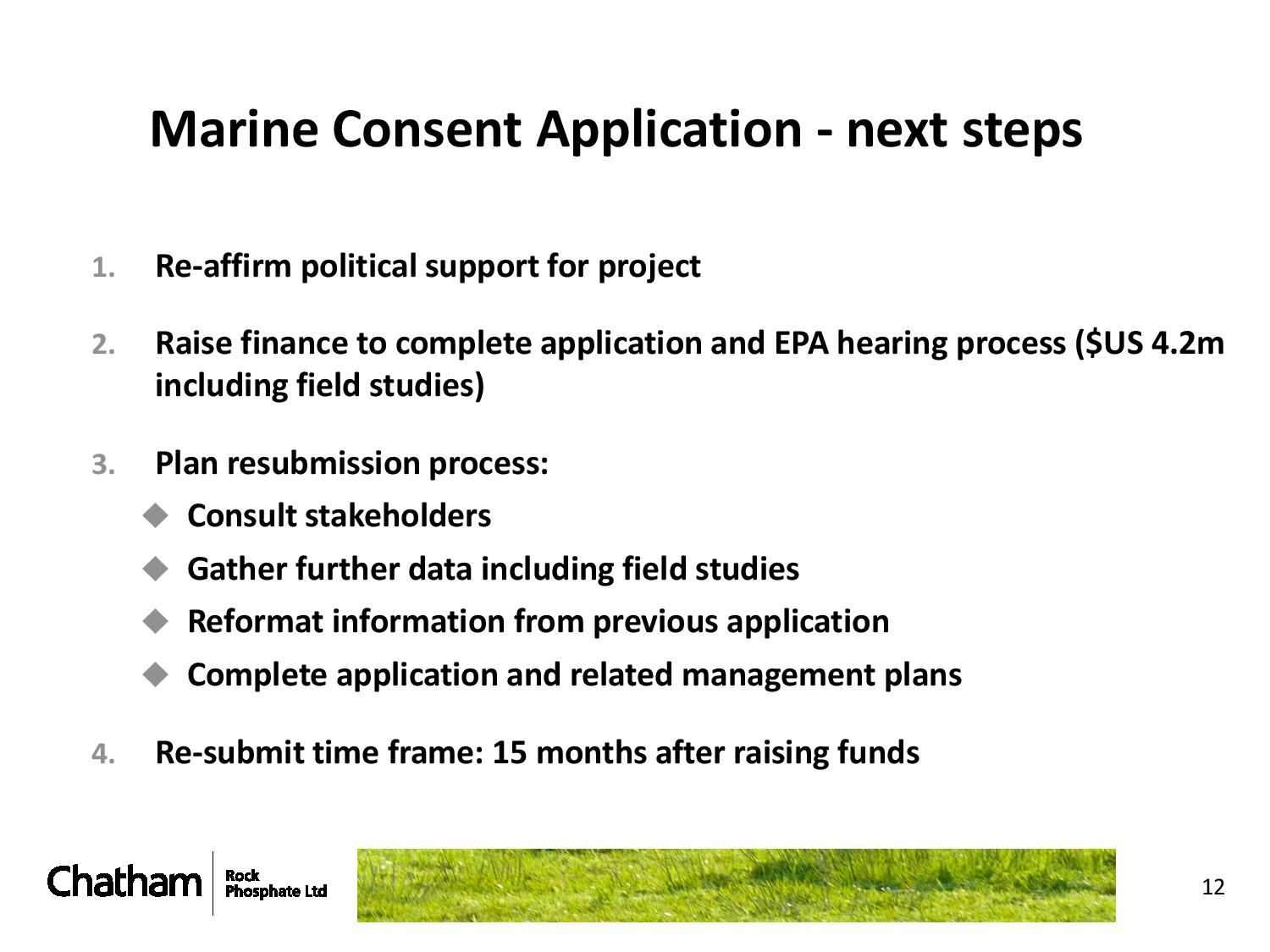

In progressing plans to submit a new application we are working with government officials to seek improvement in the permitting process and iwi, academic, industry and central government input to ensure New Zealand can benefit from an environmentally superior phosphate source.

We are also seeking to own other sustainable rock phosphate sources, to move from being a single project company and take more control of our destiny.

+64 21 5581985

+64 21 5581985 chris@crpl.co.nz

chris@crpl.co.nz PhosphateKing

PhosphateKing