Update

21 November 2014

Hearings finished – hopefully

After 26 days over seven weeks and three locations, the team had a welcome debrief over a relaxed lunch and a glass of wine.

James Winchester and Hamish Harwood from Simpson Grierson took nearly four hours to present the compelling arguments of our closing statement on Wednesday to the Decision-Making Committee with a public gallery of shareholders, and industry and government participants.

At the end of our submission DMC chair Neil Walter said the committee would now consider whether it has sufficient information to formally close the hearing. It then has 20 working days to consider its decision, currently scheduled to be made around 18 December.

Mr Walter said the committee adjourned rather than closed the hearing so they could decide if there were any outstanding issues – particularly related to our updated proposed conditions for consent. He said the committee will decide on the closing in the next couple of weeks and will then advise the date of the decision.

(Note these are detailed conditions CRP has drafted, based on feedback from expert witnesses. If you have noted some late submissions on the EPA website on the topic, don’t read too much in to them – they are simply opinions from members of the public.)

We, along with other submitters, were also asked to nominate which of four options the DMC should choose, being three levels of grant or a decline. We argued there was ample evidence to approve the full consent sought by CRP, being mining for up to 35 years across the marine consent area.

Asked whether an option to grant consent for the smaller mining permit area for 15 years was workable, we said it was not our preference (because of future consenting costs and process - but it would be obviously better than trial mining or a decline). We noted the option would involve legal and practical issues such as undertaking monitoring in a wider area, and providing for mining exclusion zones.

Which means?

We remain hopeful a decision can be delivered before Christmas but indicated in our submission if the committee needs more time we’re ok with that.

We remain very confident we will get a positive decision – the focus seems very much on how we can get across the line, rather than why we should not.

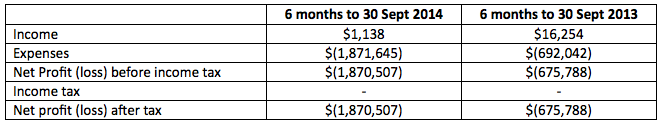

Time delays add cost though…so you can see where I’m going. The process has meant CRP commissioning further reports and late witnesses to ensure we presented the strongest case possible. We think it was money well spent but it was additional to our budgets.

In addition the EPA’s costs are higher than their budgets. We’re scrutinising them line-by-line but it looks like we’ll still be in for costs higher than planned.

So we’re still looking for more cash. If you would like to support the cause further, please talk to me this week as this is a limited opportunity at a discount to current market.

Closing submission

Our submission focused on the project’s merits but also made some observations about:

· Serious problems relating to the staff reports

· Possible improvements to the Crown’s involvement in our hearing process; its focus was limited to conservation issues rather than considering broader economic impacts or those related to farming or fishing.

· Submitters either misrepresenting or failing to understand the key issues and not approaching the hearing in a constructive manner.

Our closing submission said our proposal involves very limited environmental risks in a small area. Put simply it’s a good project worthy of consent, with economic, strategic and environmental benefits and is an opportunity for New Zealand that shouldn’t be missed.

Even the opposing experts agreed that it will not harm any other industry or resource user in New Zealand's economy. There are effects on the environment (primarily benthic habitats and organisms), but not of a scale significant in the Chatham Rise or EEZ, nor of such significance in terms of the intrinsic conservation value. The few material risks are all manageable under the framework of conditions CRP proposes and risks should be the focus of the DMC's consideration.

Fishing and Existing Interests

The areas mined will be small compared to the marine consent area - just 0.6% year or 8.6% over 15 years or 20% over 35 years, with proposed mining exclusion areas covering 19% of the marine consent area, almost equivalent to the maximum area that could be mined.

That’s miniscule on an EEZ-wide scale. In contrast fishing activities cause significant environmental effects on the Chatham Rise through dragging heavy trawling equipment over extensive areas, damaging sensitive benthic organisms (including corals) and generating sediment plumes in areas where commercial fish species accumulate. The annual average trawl footprint over recent fishing years on the Chatham Rise has been 17,791 km2.

The effects of fishing activities must be considered when assessing the nature, scale, and significance of the effects of CRP’s proposal. Despite widespread destruction, damage and removal of fauna such as sponges and corals, there are no reported significant ecosystem effects from this habitat loss – fishermen catch their quota from the same places year after year.

Cultural Interests

We also said the EEZ Act does not, except in limited circumstances, provide for a cultural interest to be an existing interest. The location of the proposal must also be relevant.

What is the basis for an existing interest from a cultural perspective being claimed for an area of seabed 450km from the mainland and 250km from the Chatham Islands? What is the lawfully established existing activity that takes place there or would otherwise be affected by the proposal if it is not fishing?

Because social and cultural factors are absent from the EEZ Act definition of “sustainable management” the focus of the DMC’s decision must be on economic and environmental considerations. This view is supported

By legal advice provided last week by the DMC’s own lawyer.

Sufficient Information

The models used in evidence are based on significant data which we’ve always accepted would need some final validation. Given the significant input data there should be no difficulty for the DMC concluding the information provided met the EEZ Act’s definition of best available information.

Regarding Benthic Protection Areas, we said there would be benefits if a more refined series of protected areas was created. CRP’s proposed non-mining areas and its best endeavours to achieve full legal protection for them could be an important first step and an initiative that CRP would take great pride in pioneering. Given the vacuum of national ocean management policy that is all that can realistically be done at this time.

EPA Staff Reports

We continue to be concerned about the staff reports regarding issues of bias, fairness, natural justice, lack of expertise, timeliness, relevance, and the level of assistance they provide to the DMC.

The EPA staff’s answers to questions when under cross examination also raised many concerns including their failures to have read or understood relevant documents, their ability to assess CRP's effects and issues in context or even to appropriately interpret the Act and to arrive at a correct legal view.

They couldn’t explain how and why the organisation had made decisions or reached a view as to how the Act should be applied and had either misunderstood or were ignorant of the expert evidence presented and which was not now in dispute.

They did not understand even basic scientific issues and were unwilling to advise the DMC about possible conditions or how it should approach various evidential issues. Instead they adopted an unduly negative and conservative assessment, falling back on "uncertainty" without putting it into any context.

For all those reasons we don’t think the DMC should place weight on any staff findings and we certainly don’t think we should be expected to pay for work which has added no value to the process and provided no material assistance to the DMC.

Further, staff reports are not required under the EEZ Act at all and are merely a practice the EPA staff have

adopted for some reason best known to themselves. However, it’s obvious that staff reports are at best a complication and at worst a hindrance to the marine consent process.

Project Summary

To sum up, the project offers new environmental benefits for New Zealand’s farming industry, by using a low cadmium, low carbon footprint, low run-off, potentially organic product. It will create a new industry with strong ties to agriculture, New Zealand’s most important export earner. CRP’s product will enhance security of supply and reduce exposure to politically risky sources of a critical input to New Zealand’s biggest industry.

Last Thought

If you need another reason why this project is important consider the comment from Rabobank board member Berry Martin to the F20 (the farmers global meeting held to coincide with the G20 in Australia).

“We need to double world food production by 2050 but with half the resources. We are already using more than one planet’s resources so we need to be more efficient.”

If you want to read the whole submission go to:

http://www.epa.govt.nz/EEZ/chatham_rock_phosphate/hearing/daily_transcripts_proceedings/Pages/Hearing-Day-26.aspx

Chris Castle, Managing Director

chris@crpl.co.nz or +64 21 55 81 85

+64 21 5581985

+64 21 5581985 chris@crpl.co.nz

chris@crpl.co.nz PhosphateKing

PhosphateKing