The recent postponement of the overseas IPO means that Chatham Rock

Phosphate has an immediate need to raise money. Private placement

finance is being targeted but the summer holiday break has caused delays

in finalising these arrangements.

For this reason, and to give existing shareholders another

opportunity to participate, it was resolved to proceed with the current

Share Purchase Plan now, even though it's holiday time. It has now been resolved to extend the closing date for the Share Purchase Plan to 3 February 2012.

CRP has 255 shareholders and a subscription from each would enable

the Company to retain some momentum while the process to raise money by

means of private placements continues. The maintenance of this momentum

would also assist in the private placement negotiations. This is why we

negotiated the recent equity financed deal with Odyssey Marine to

collect the data discussed in our news release of 19 December.

As an existing shareholder in CRP you have provided tangible support

in the past. I'm particularly pleased that at recent prevailing share

prices every shareholder who has taken up shares in the company in the

various financings undertaken since its inception five years has an

investment that is worth substantially more than cost.

You will recall that CRP shares were valued (by two independent

valuers) at 70.6 cents in March 2011 ($34 million for the company).

Since then there have been a number of encouraging developments:

- The market price of rock phosphate ex Casablanca has moved from $160/t to $202.50/t.

- Market development work has identified a range of potential buyers for our rock phosphate both in New Zealand and overseas.

- Mid 2011 exploration work identified further previously unknown

resources in the only two areas CRP tested. The same work lead to the

discovery of what appear to be significant glauconite resources in

CRP's licence area.

- University research CRP funded in neighbouring areas of the

Chatham Rise has led to the identification of much higher

concentrations of glauconite. This also has potential to be recoverable

by CRP as a by-product.

- CRP has received tangible government encouragement to commission

research and scoping studies into beneficiating its rock phosphate. If

successful this would be expected to lead to higher prices and greater

market penetration.

- CRP has acquired 6 months of environmental baseline data from two moorings on the Rise.

- CRP selected Boskalis in the dredging company beauty parade and

has subsequently contracted them to proceed with design of the mining

and separation plant.

- CRP has agreed terms re equity funding stage one of a survey

cruise by Odyssey Marine (at CRP's option) CRP has engaged two

fertiliser scientists to provide independent advice on the

characteristics of our rock and its utility and value to fertiliser

companies..

- CRP has virtually completed the various documents and processes

required for an overseas listing including an independent technical

report, the prospectus and share-broker due diligence.

- CRP has identified new directors with the required relevant skills to join the Board upon the overseas listing.

- CRP has in the last few weeks acquired significant new data about

the rock phosphate deposit which will assist in optimising phosphate

extraction and system design.

On the basis of this progress during the last nine months it could

realistically be argued that the company valuation has increased.

However at the recent share price of 20 cents the present market

value of the company is only $10 million and while disappointing in one

sense, this offers an opportunity to shareholders to increase their

shareholding in the company at this attractive entry point.

Any subscription you decide to make in the range from $500 to $15,000

will be welcome. The share purchase plan will now close on 3 February

and we will have the ability (but not the obligation) for the next three

months to place any shortfall that eventuates on the same terms and

conditions. As we are proposing to reactivate the overseas IPO as soon

as market conditions improve this may present an attractive second

opportunity to qualified investors.

Your support of the company in the past and hopefully again during this period is appreciated.

Please feel free to contact me on 021 558 185, or by email to chris@widespread.co.nz if you wish to discuss this further.

Regards and all the best for 2012,

Chris Castle

Managing Director

About Chatham Rock Phosphate

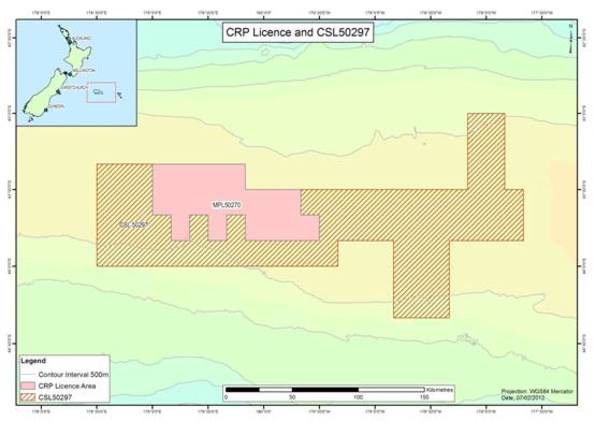

Chatham Rock Phosphate Limited holds an offshore prospecting permit

covering an area of 4,726 km2 on the central Chatham Rise. The permit

area, which is in New Zealand territorial waters, is located 450 km east

of Christchurch and includes significant shallow seabed deposits of

rock phosphate. The initial term of the permit is two years with rights

to either extend the prospecting permit or apply for a mining licence.

Establishment of a rock phosphate industry in New Zealand territorial

waters has a significant number of economic, environmental and market

benefits.

The economic benefits include

- Import substitution of up to $300 million annually

- Possible exports to near markets

- Reduced commodity risk for fertiliser manufacturers and farmers

- Reduced foreign exchange risk for fertiliser manufacturers and farmers

- Development of a new NZ industry

- Generation of additional income for the local economy

- Security of supply (most rock phosphate is imported from North Africa and the Middle East)

The environmental benefits include

- Local product is significantly lower in cadmium and uranium than imported product

- Much lower carbon footprint than imported product

- If applied as a direct application fertiliser, CRP has less run

off than super-phosphate, is applied less frequently, and is a more

effective, slower acting product

- Extraction will occur in accordance with International Marine Mining environmental guidelines

The market benefits include

- Much cheaper source than Morocco

- Nominally 25+ years security of supply

- Known extraction costs could enable less volatile price contracts,

which will benefit fertiliser companies, farmers and agriculture

outputs generally

Environmental considerations are essential and CRP has an ongoing

wide-ranging programme of consultation with fishing, conservation, Maori

and other interest groups around these matters.

+64 21 5581985

+64 21 5581985 chris@crpl.co.nz

chris@crpl.co.nz PhosphateKing

PhosphateKing