Report : Chatham Island Long-Finned Eels - Breeding, Migration and Return

/To read the report entitled 'Chatham Island Long-Finned Eels - Breeding, Migration and Return' - Click Here

To read the report entitled 'Chatham Island Long-Finned Eels - Breeding, Migration and Return' - Click Here

To read our latest Shareholder Newsletter update - Click Here

To read Q&A Environment : Questions Answered Fact Sheet - Click Here

Dear Chatham Rock Rock Phosphate shareholder,

This announcement was released to NZX a few minutes ago.

Regards,

Chris Castle

CEO

Chatham Rock Phosphate

Limited

P.O. Box 231, Takaka

7142

Mobile: +64 21 558 185

chris@crpl.co.nz

Skype: phosphateking

www.rockphosphate.co.nz

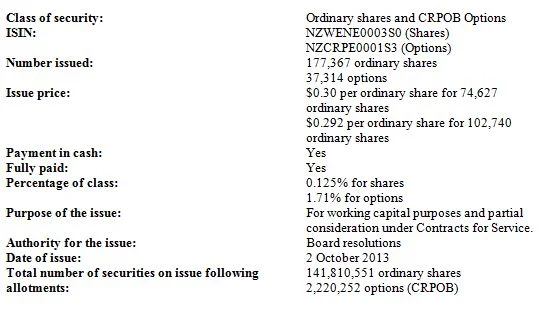

Allotment of Shares and Options

Chatham Rock Phosphate Limited (NZX: CRP) advises that it has today undertaken placements at $0.30 per share and at $0.292 per share.

74,627 ordinary shares were issued at an issue price of $0.30 per share to a qualified investor. This investment is on the terms of the current private capital raising offer announced to the market on 9 September, being:

• CRP agrees an amount of shares to be subscribed for by an investor in aggregate.

• Half of the shares are subscribed for at an issue price of $0.30 per share (Tranche One).

• The investor commits to subscribing for the balance of the shares at $0.35 per share within 2 weeks of the Company being granted a mining licence in respect of its Chatham Rise phosphorites project (Tranche Two).

• For every two shares subscribed for under Tranche One and Tranche Two, one option (CRPOB) is also allotted to the investor.

Accordingly this represents a $50,000 committed investment with $23,000 paid for the shares allotted today and $27,000 to be paid for Tranche Two.

In addition two contractors of the Company (CRP-OCS Consulting Limited and Robin Falconer Associates Ltd) have each received 51,370 shares under Contracts for Service at $0.292 per share. These shares represent partial payment for services. Pursuant to those contracts for service the issue price of NZ$0.292 per share reflects the 20 day volume weighted average price of a share on the NZAX market to 30 September 2013.

Chris Castle

Chief Executive

Email: chris@crpl.co.nz

An article of interest to Chatham Rock Phosphate – an interview from the Wall Street Journal with Jeremy Grantham, the chief investment strategist at GMO who identifies phosphate as one the best future mineral investment options due to its rarity, value to the agricultural sector and the Middle Eastern dominance of supply.

To read the article on line - click here

Text of online article:

JEREMY GRANTHAM'S GOT A TRACK RECORD that's impossible to ignore—he called the Internet bubble, then the housing bubble. While moves like those have earned the famed forecaster the nickname "perma-bear," in early 2009 he also told clients at GMO, his $100 billion, Boston-based money-management firm, to jump back into the market. It was the same week that stocks hit their post-Lehman low.

Now, however, the outspoken Yorkshireman, who is chief investment strategist at GMO, is making headlines with a new prediction: Dire, Malthusian warnings about environmental catastrophe. To hear him tell it, the world is running out of food. Resources will only keep getting more expensive. And climate change looms over it all. Indeed, at times he sounds like someone Greenpeace would send door-to-door with a clipboard. (He's not above likening the coal-industry spin to the handiwork of Goebbels.) If it were anyone else, Wall Street would probably laugh him off. But because it's Jeremy Grantham, they just might listen.

Q: You've been ringing alarm bells about commodity prices. Why all the worry?

A: They came down for a hundred years by an average of 70 percent, and then starting around 2002, they shot up and basically everything tripled—and I mean, everything. I think tobacco was the only one that went down. They've given back a hundred years of price decline and they gave it back between '02 and '08, in six years. The game has changed. I suspect the game changed because of the ridiculous growth rates in China—such a large country, with 1.3 billion people using 45 percent of the coal used in the world, 50 percent of all the cement and 40 percent of all the copper. I mean these are numbers that you can't keep on rolling along without expecting something to go tilt.

Q: This led to some surprising conclusions, like your concerns about natural resources most of us have barely heard of.

A: We went through one by one, and we decided the most important, the most valuable and the most critical was phosphate or phosphorous. Phosphorous cannot be made, only placed. It is necessary for all living things. And we are mining it, and it's depleting. And I like to say, if that doesn't give you goosebumps, then you're tougher than me. That is a terrible equation. So I went to the professors, and I said, what's going to happen, and they said, 'Oh, there's plenty of phosphorous.' But what's going to happen when it runs out? 'Oh, there is plenty.' It's a really weak argument. We do have a lot, but 85 percent of the low-cost, high-quality phosphorous is in Morocco…and belongs to the King of Morocco. I mean, this is an odd situation. Much, much more constrained than oil in the Middle East ever was—and much more important in the end. And the rest of the world has maybe 50 years of reserve if we don't grow too fast.

Q: What are investors supposed to do?

A: The investment implications are, of course, own stock in the ground, own great resources, reserves of phosphorous, potash, oil, copper, tin, zinc—you name it. I'd be less enthusiastic about aluminum and iron ore just because there is so much. And I wouldn't own coal, and I wouldn't own tar sands. It's hugely expensive to build coal utilities, and the plants they have to build for tar sands are massive, and before they get their money back I suspect that the price of solar and wind will have come down so much.

So I wouldn't use that, but I think oil, the metals and particularly the fertilizers, I would own—and the most important of all is food. The pressures on food are worse than anything else, and therefore, what is the solution? Very good farming, which can be done. The emphasis from an investor's point of view is on very good farmland. It's had a big run. You can never afford to ignore price and value, but from time to time you can get good investments in farmland, and if you're prepared to go abroad, you can do it today. I wouldn't be too risky. I would stay with distinctly stable countries—Australia, New Zealand, Uruguay, Brazil, Canada, of course, and the U.S. But I would look around, in what I call the nooks and crannies. And forestry is the same. Forestry is not a bad bargain, a little overpriced maybe, but it's in a world where everything is overpriced today, once again, courtesy of incredibly low interest rates that push people into investing. A wicked plot of the Federal Reserve.

To read the article on the NZ herald site - Click Here

Text from online article:

The rough seas of the southern Pacific Ocean are set to be the focus of resource consent debate as a mining company's bid to dredge the sea floor comes up against the fishing industry and environmentalists. Andrew Stone reports

Chris Castle and partner Linda Sanders are part of the team heading up Chatham Rock Phosphate.

Alfred Preece has crossed the heaving seas that separate New Zealand and the Chatham Islands three times.

"It's a wild piece of water," says the farmer and Chathams' mayor. "You need to be on your guard out there."

"Out there" is the Chatham Rise, fast becoming the aquatic battleground of the country's next big resource conflict - pitting a small, ambitious mining company against the fishing industry, which on this occasion has the environment lobby on its side.

The project generating strident invective as big as the roaring 40s swells that roll through the stretch of southern Pacific Ocean involves plans by miner Chatham Rock Phosphate to hoover up the top 30cm of sea floor and pump it 400m up to a big ship where the marine silt will be sifted for nodules of rock phosphate before the sediment is pumped back to the seabed.

The miner has its eyes on 450sq km of the Chatham Rise, a flat-topped ridge that runs 700km beneath the sea from Canterbury to the Chathams. Warm ocean currents from the tropics meet cold sub-Antarctic waters above the ridge, making the area one of New Zealand's most productive fishing grounds, as well as a key element in the Chathams economy.

The process of extracting phosphate lumps from the sea floor is far from straightforward. Besides the technical challenges it faces, Chatham Rock, which has ploughed millions into the project, still needs two vital consents before its partners in the venture can start work.

It is striking formidable resistance in New Zealand and wariness on the Chathams, where Mayor Preece says the islands' dependence on the sea has made the community apprehensive about new technology in their maritime backyard.

The latest critic to weigh in against the scheme was Green Party MP Gareth Hughes, who this week argued that the law covering the deep-sea riches was inconsistent.

"I think it makes a mockery of our marine protections to allow literally vacuuming up the seabed in a marine protected area," Hughes said.

The MP was referring to the status of the Rise as a Bethnic Protection Area, which makes it off-limits to bottom dredging but not, under existing law, to seabed mining.

Chatham Rock managing director Chris Castle replied in an open letter: "We're astonished you have formed such a negative opinion about our project given the compelling potential environmental and economic benefits it offers and its minimal environmental impacts."

In a nutshell, Castle's remarks identified where this conflict is likely to be settled - the environmental battlefront.

Castle, an accountant who cut his teeth in the hard-nosed corporate world of Brierley Investments, insists his company wouldn't contemplate the new undersea frontier if the work caused "more than very minor environmental impacts".

He says 85 per cent of the material it wants to lift from the Chatham Rise would be placed back from where it came. "Modelling indicates the material will not be widely dispersed and the sediment that doesn't immediately settle will rapidly dilute to insignificant levels."

He says more than 30 expert reports commissioned by Chatham Rock for a draft environmental impact assessment had not identified any long-term impacts on fish habitats - a key claim because of the fisheries interests.

Castle insists that any impacts would be confined to the areas mined, and be "short-term, reversible and of low environmental risk".

Responds George Clement of the Deepwater Group, a fisheries industry lobby: "We just don't know."

Clement calls the project "potentially catastrophic" for the marine environment and fears that sediment plumes carried on sea floor currents will drift over long distances, smothering corals and sponges that act as nurseries for valuable fish species. "We need to be reassured that this isn't so," he says, and uses the term "strip mining" to describe the scheme.

Argues Clement: "Our seafood is here forever, long after the phosphate has gone."

Chatham Rock and the Deepwater Group also have exchanged barbs over their technologies. Castle, the mining advocate, says his project has to jump through the hoops to get a mining licence and a marine consent, the underwater equivalent of a resource consent.

"These cost millions of dollars, require years of research, consultation and official process and involve full public scrutiny."

Bottom trawling, he argues, needs no consents and each year disturbs or destroys creatures more than 50,000 sq km of New Zealand's seabed. He believes the fishing industry is making a rod for its own back by reminding those observing the controversy just how destructive of the sea floor its methods can be.

Clement uses his own analogy to compare seabed mining and bottom trawling. "It's like [comparing] a bulldozer in a national park removing all life including topsoil down to half a metre with a farmer running over his paddock with a roller. "

He calls the Chatham Rise "our CBD" and says he could imagine the uproar if a miner wanted an open-cast dig across the Auckland isthmus.

Responds Castle: "We're not losing any sleep over the nonsense coming out of the Deepwater Group ... they regard it as their sandpit and don't want us there at all. They've just decided they don't want us on their patch."

Phosphate nodules formed by a complex interplay of ancient erosion, ocean chemistry and currents have lain undisturbed on the Chatham Rise for millions of years. Discovered in the 1950s, the deposits caused flutters of excitement 30 years ago when the Government and some big corporates took a close look at exploiting the resource. Costs made the work prohibitive then, but a shift in phosphate prices and new mining technology has put the nodules within tantalising reach.

Three years ago Castle, managing director of Chatham Rock, secured an exploration licence covering 4726sq km of the Chatham Rise. The licence - issued on a first come, first served basis - remains the company's most valuable asset, though Castle says the knowledge it has built up about the sea floor resource and the means to extract it is valuable intellectual property.

Castle is chuffed his company - he calls it a "tinpot" set-up from Golden Bay - is still afloat when swags of miners have gone to the wall. He runs the show from an office in Wellington, where he and his partner, Linda Sanders, spend the working week before flying back to their home at Onekaka, a tiny settlement near Takaka that in the 1920s supported an iron ore industry. Sanders, who writes an investment column for the Listener, chairs Chatham Rock's board and is charge of corporate affairs. Its team includes a geologist, scientist and an environmental consultant.

Castle has had the mining bug for years, ever since he worked in the minerals arm of corporate raider Brierley. He created Charter Corp, which collapsed in 1988, and went on to set up mining investor Widespread Portfolios, now called Aorere.

Financing the Chatham project had been tough, recalled Castle, with capital markets going into a tailspin after the global financial crisis. A breakthrough came last year when Subsea Investments, an American private equity firm, took a stake in the company, before Dutch multinational Royal Boskalis got on board. Odyssey Marine, an American firm specialising in recovering shipwrecks with submersible robot craft, also has a share in Chatham Rock.

Boskalis took its slice in return for the early mining work. It is also designing the technology to recover the fertiliser and, if the consents come through, would adapt one of its giant vessels for the mid-ocean work.

The big dredging company would need to modify one of its 200m long vessels to harvest the phosphate. Each trip would cover a 12-day cycle. Three days would be set aside to fill its holds 50,000 tonnes of phosphate, with a further nine days to unload the cargo and return to the Chatham Rise.

Company estimates say the resource could be mined for at least 15 years, deliver a $900 million benefit to New Zealand, and offset the need to import phosphate from Morocco.

Given the forbidding environment where the ship must operate, Chatham Rock expects that wild weather could sometimes disrupt work. But the miner still expects to shift 1.5 million tonnes of phosphate each year from the sea floor to an as yet undetermined New Zealand port.

Castle admits the project has taken longer than his company had anticipated. In public statements, Chatham Rock was confident of getting its mining licence this year, with work starting in 2015. That date has been pushed back to 2016. Castle says his company has received a "letter of comfort" from NZ Petroleum and Minerals, the Economic Development Ministry agency which manages the country's oil, gas, mineral and coal resources, that they are dealing with the application as a matter of priority.

He doesn't expect further hiccups. "We expect to get both permits by mid-2014. Then's it's two years to modify the ship. The day we get those consents this company is worth $500 million." Its present market capitalisation is $46 million.

Castle has been active building support for the project. He's taken a team to the Chathams, suggesting the mining could be a "game-changer" for the windswept territory. As part of its pitch, the company has mentioned delivering a load of phosphate, suggested service jobs could be created and raised the possibility of stationing a helicopter for emergencies on the island.

In Wellington, Castle acknowledges he is "frequent visitor" to the Beehive and says he has worked hard to promote his scheme to ministers and officials. There remains some way to travel. No extraction at this depth has been tried before. Furthermore, the matter of marine consents is new bureaucratic territory. Just this week authorities in faraway Namibia put the brakes on an undersea plan to mine phosphate nodules. Reports said an 18-month moratorium had been slapped on offshore mining activities because of environmental uncertainties.

"In the end it's going to come down to the science," asserts Castle. He says the marine consent hearing by the Environmental Protection Authority - the first under a new law - will be persuaded by the facts, not signatures on a petition or lobbying by the fishing industry.

Over on the Chathams - the land at the end of the weather forecast - Mayor Preece says islanders view the plan to mine with a mixture of excitement and concern. "Fishing is our lifeblood. It's been the case since the days of whaling and sealing, so we're concerned that the industry we have now is not damaged in any way."

A farmer, Preece says Chatham Rock's suggestion of a shipment fertiliser went down well, given its prohibitive cost. "If it goes ahead safely we'd be keen to see some of the royalties come our way. We just don't want to get ripped off."

Economic feed

• Each year New Zealand uses about one million tonnes of phosphate, worth $300 million, to encourage pasture growth to drive its land-based economy.

• The fertiliser is made from rock phosphate from Morocco. There is, however, a catch - the north African phosphate contains relatively high levels of cadmium, a toxic element found naturally in soils. Chronic exposure to the heavy metal has been linked to kidney failure and brittle bones.

• Cadmium levels in New Zealand soils and farm animals are monitored by the Ministry for Primary Industries as part of a programme managed by the Cadmium Working Group, which includes state agencies, primary sector groups and the fertiliser industry.

• MPI says evidence to date indicates cadmium in soils poses no immediate concern, though export bans have been imposed on kidneys from sheep and cattle over 30 months. New Zealand fertiliser companies have a voluntary limit of 280 parts per million of cadmium for manufactured superphosphate.

• Chatham Rock Phosphate says tests on samples collected from 11 locations on the Chatham Rise showed an average of 2.2 parts per million. The lowest value was 1.3ppm, with a high of 5.3ppm. It argues the lower level is a factor in its favour in its bid to secure consents to mine the seabed.

Click on the image below to enlarge and read an article on Chatham Rock Phosphate in The National Business Review 20th September 2013.

To read the article on stuff.co.nz - click here

Article text:

OPINION: After much squawking, the Government will allow fishing enthusiasts to take seven snapper, rather than nine, when they head out in the boat.

A new recreational limit of three snapper had been proposed but the white-hot anger of weekend anglers soon saw to that. Now, those same anglers will, unsustainably, deplete snapper stocks.

The little guy has won - and snapper don't vote. No wonder we are worried about our 100% Pure brand.

The commercial fishing industry - blameless, in that it is catching to its regulated snapper limits - copped a lot of nasty flak, nonetheless. That is the trouble with being the fishing industry.

No-one thinks much of you, even when you try your best to protect the environment through the quota management system, still world-leading 30 years on.

Being kicked around unfairly seems to have rubbed off on parts of the fishing industry itself.

The unusually vehement attack by the Deep Water Group, representing deep-sea fishing companies, on Chatham Rock Phosphate's mining plan for the Chatham Rise is a case in point.

Corporate arm-wrestling is more usually resolved out of the public eye by commercial players who respect one another's desire to create wealth and have no desire to destroy value without good cause.

CRP wants to hoover up about 30 square kilometres a year of seabed on the Chatham Rise to remove valuable phosphate nodules embedded in the sediment, returning about 85 per cent of what it scoops up to the sea floor.

It would provide an indigenous source for the $100 million of phosphate imported annually for New Zealand farms from Morocco, creating economic productivity, balance of payments benefits and, potentially, a new export industry.

"We wouldn't consider extracting phosphate nodules from a very limited area of the Chatham Rise if we expected it to cause more than very minor environmental impacts," said CRP's aggrieved chief executive, Chris Castle, in an open letter this week to Green MP Gareth Hughes.

But the fishing industry is dead-scared that depositing spoil back on the ocean floor will create plumes of sediment that could affect the health of the surrounding ocean - a main feeding ground for juvenile hoki (one of the industry's most valuable fisheries).

Castle argues he is targeting a relatively small 30 sq km of seabed every year for 15 years, whereas the fishing industry is bottom-trawling about 119,000 sq km in unprotected areas of the Chatham Rise annually, in perpetuity.

Both sides claim they are misunderstood. The fishing industry says bottom-trawling is really only "bottom-skimming". CRP says its multimillion-dollar investment in understanding local ecology and environmental impacts means the two should be able to co-exist.

Ad FeedbackEnvironmental lobbies that are fans of neither bottom-trawling nor deep sea mining are automatic winners in this corporate tit-for-tat.

While Hughes has lined up with fishing interests against CRP, they are, at best, fairweather friends - especially as Hughes' biggest concern is reportedly the destruction of sea floor corals.

This concern appears better founded than fears for juvenile hoki.

For a start, mining would kill everything that lives on the sea floor in the sea floor mining blocks.

After all, that is what mining does, wherever it happens. Fish can move away. Coral can't.

And while the mining blocks are small total areas, CRP's modelling shows sediment can drift up to 80km on ocean currents, although it should settle at a thickness of half a millimetre or less for most of that area. Anything above 1mm could be bad news for corals but not for fish stocks.

Most of that sediment would settle in the 820 sq km mining licence area CRP will apply for - close to 10 per cent of the benthic protected area where the phosphate is located.

The fact that CRP's proposal is inside an area protected from bottom-trawling creates a serious perception issue for Castle. The Deep Water Group's executive director, George Clement, likes to describe benthic protected areas as "underwater national parks" and "parts of the conservation estate", and says the fishing industry made "the difficult call" to stop bottom-trawling in these areas.

None of these claims are strictly true.

The benthic protected areas are fisheries exclusion zones - chosen because the fishing industry did not fish there anyway.

In principle, seabed mining is not prohibited. However, it gives both concerned fishermen and environmentalists a big hook on which to hang their objections, long before CRP's formal consent application gets in front of the Environment Protection Authority, the new agency regulating the exclusive economic zone.

CRP is a small, lightly capitalised company, which has done well to bring aboard its joint venture partner, Dutch seabed mining experts Boskalis, but it needs to keep tapping investors to fund its plans. These could scatter like reef fish at enough signs of trouble.

That would be a shame. CRP's plan is bold and potentially valuable to New Zealand. It deserves the opportunity to be considered with formality and care by the authority, not decapitated in the court of public opinion by a commercial competitor for resources.

Dear Chatham Rock Phosphate shareholder,

This letter has just been sent to Green MP Gareth Hughes, filed with NZX and sent to the media.

Regards,

Chris Castle

CEO

Chatham Rock Phosphate

Limited

P.O. Box 231, Takaka

7142

Mobile: +64 21 558 185

chris@crpl.co.nz

Skype: phosphateking

www.rockphosphate.co.nz

17 September 2013

Open letter to Gareth Hughes, Green MP

Dear Gareth

I was very disappointed to see you had aligned yourself publicly with the bottom trawling industry in a news item on TV3 at the weekend.

In our briefing to you last year you indicated you had not reached any conclusion about the merits of our project. I would have thought that you would make an informed decision, including discussion of your concerns with us, before going public for the sake of a TV sound bite.

You have publicly said you are not against mining per se and will evaluate each project on its merits. We wonder how much faith to put in that statement if the evaluation is based on so little consultation and so few facts. If you have ruled out this mining project as well as countless others, are there any you do support?

We’re astonished you have formed such a negative opinion about our project given the compelling potential environmental and economic benefits it offers and its minimal environmental impacts.

To remind you:

1. Chatham Rise rock phosphate, as an ultra-low cadmium direct-application fertiliser, has proven to be as effective as processed fertilisers while reducing run-off effects on New Zealand waterways by up to 80%.

2. This resource provides fertiliser security for farming by providing a local alternative source. Most rock phosphate used to make fertiliser now is imported from Morocco.

3. Moroccan rock phosphate is high in cadmium, involves high transport costs and has a significant carbon footprint.

4. New Zealand is predicted to be $900 million richer as a result of our new industry and we’ll be generating annual exports or import substitution of $300 million, plus supporting farming, our biggest earner.

5. By area, the economic value of the phosphate resource is 500 times greater than fishing; it is expected to yield $9.1 million per km2. In contrast, bottom trawling yields less than $20,000 per km2.

So while our operations will have some environmental impacts, they also offer very significant environmental and economic benefits.

The TV3 news item noted your alliance with the fishing industry is an unlikely one. I agree, given bottom trawling’s massive environmental impacts and lack of environmental oversight.

Our proposed mining operation is subject to a rigorous environmental evaluation and monitoring process. The story that should be getting your attention is not the potential environmental impact of our project, but the freedom of the fishing industry to devastate as much of our EEZ as they like (currently about 50,000 km2 per year, or 385,032 km2 or 9.3% of the EEZ since 1989) with no environmental oversight or monitoring.

We wouldn’t consider extracting phosphate nodules from a very limited area of the Chatham Rise if we expected it to cause more than very minor environmental impacts. Our operations will lift the top 30cm of sandy silt and redeposit 85% of it on the same area of seabed after extracting the nodules. Modelling indicates the material returned will not be widely dispersed, and the sediment that doesn’t immediately settle will rapidly dilute to insignificant levels.

Our draft environmental impact assessment (EIA), supported by more than 30 expert reports, has identified no long-term impacts on key spawning, juvenile and young fish habitat. Any potential impacts are predicted to be confined to our limited extraction areas, and are short-term, reversible, and of low environmental risk.

But while bottom trawling – ploughing vast tracts of the EEZ seabed decade after decade - requires no environmental consents, our project needs a mining licence and a marine consent. These cost millions of dollars, require years of research, consultation and official process, and involve full public scrutiny.

Chatham’s planned 15-year extraction project will touch a total of 450 km2, far less than 1% of the Chatham Rise. In contrast, over the same period fishing will bottom trawl 750,000 km2, about three times the size of New Zealand.

Year after year, weighted nets scrape about 50,000 km2 of seabed, with bottom-dwelling animals disturbed or destroyed – mostly repeatedly so areas never have the chance to regenerate. Up to 3,000 km2 of new territory is disturbed annually - an environmental impact 100 times greater than predicted for phosphate extraction. Each year we plan to touch just 30 km2.

Scientific research shows that hoki spawning is concentrated on the West Coast of the South Island and in Cook Strait, and juvenile growth occurs over the entire 189,000 km2 rise. The annual fish trawl footprint on just the Chatham Rise during the 2009-10 fishing year was 19,051 km2.

The Deep Water Group members therefore already know they can continually disturb the ecosystem of 10% of the Chatham Rise area without harming juvenile fish stocks. Chatham’s extra annual 30 km2 are likely to have no significant additional effect on the hoki fishery.

In summary, fishing destroys the benthic habitats of 100 times the area of previously untouched sea floor every year than we plan to, and every year fishing stops regeneration on an area of seafloor almost 2,000 times greater than our planned area of impact.

Thanks partly to Chatham’s $20 million investment, the rise’s benthic environment is now one of the best-known parts of our marine territory, and this information can now inform resource and environmental management decisions, possibly including modifying the location of benthic protection areas. We’ve spent three years collecting data on oceanographic conditions (tides, currents, turbidity), benthic life, and analysing the impacts of disturbances on the seafloor and in the water column so we can design a mining system and operational plan that minimises environmental impacts and protects areas of benthic habitat.

Rather than being of environmental concern, ours is a project of national significance offering significant economic and environmental benefits.

A word or two about BPAs

Benthic Protection Areas were promoted by the fishing industry, for the fishing industry, and were specifically designed to avoid fishing areas, especially those relating to bottom trawling. BPAs include a representative sample of benthic habitats, spread geographically to ensure adequate latitudinal and longitudinal variation. The map shows how they avoid bottom- trawling areas.

BPAs were designed without regard for New Zealand’s other important natural resources such as rock phosphate or massive sulphides.

BPAs were implemented to protect benthic biodiversity, not fish spawning grounds or nurseries, though that may be a side benefit for some species.

BPAs are only covered by fisheries legislation. They do not relate to other legislation covering other ocean activities, such as the newly enacted EEZ legislation, which expressly excludes any direct reference to BPAs. Consideration of the relative importance of BPA’s will be part of the environmental impact assessment process managed by the Environmental Protection Authority.

The fishing industry also used the introduction of the BPAs to substantially reduce its monitoring costs, even though establishing BPAs made no difference to its ability to bottom trawl in the vast majority of the EEZ. In recognition of the contribution BPAs would make to marine protection, the government agreed any research relating to the potential effects of bottom trawling on the benthic environment or its biodiversity should be two-thirds Crown funded and one-third industry funded.

Chris Castle, Managing Director Chatham Rock Phosphate

Attached: graphic showing the fish bottom trawl footprint of the EEZ prior to establishing the BPAs

Shareholder Update September 2013

To read the latest Chatham Rock Phosphate shareholder update - Click here

For more information contact Chris Castle at: