Marine Consent Application and EIA - Non Technical Summary

/To read the full report - Click Here

To read the full report - Click Here

To read the full article online - click here

27th Feb 2014

Dominion Post

DAVE BURGESS

A NUMBER of wealthy groups have expressed interest in investing in Wellington-based Chatham Rock Phosphate (CRP) when it lists on the London AIM market.

AIM is the secondary market of the London Stock Exchange for smaller growing companies.

CRP chief executive Chris Castle said because there was no associated public offering with the secondary listing it was expected to take between two to three months to complete.

‘‘I met about 15 different groups [on a recent visit to Britain]. They had already been vetted and they wanted to meet me and were interested in what we are doing.

‘‘There was a strong flavour that our stock needed to be listed on a more accessible market ... hence the decision to go for the AIM listing. We are not doing an IPO [initial public offering]. We are getting to a market place were people are happy to get out their chequebooks.’’

NZX-listed CRP holds a 20 year mining permit, issued last year, to vacuum the sea floor for phosphate nodules from an 820 square kilometre area of the Chatham Rise.

It has applied for new prospecting licences both east and west of its existing licence areas.

The company is finalising its environmental impact assessment for its Marine Consent application, which it needs from the Environment Protection Authority, before it can start operations.

Castle expects the application to be filed by the end of March, to be formally accepted by the authority in April, and all going well to have the licence no later than early November.

The AIM listing is part of a drive to raise $6 million to fund the consent application

Dear Chatham Rock Phosphate shareholder or potential investor,

This announcement was released to NZX a few minutes ago.

If you wish to be added to the underwriting panel for any possible rights issue shortfall, please contact me by return email.

Regards,

Chris Castle

Chief Executive Officer

Chatham Rock Phosphate Limited

Email: chris@crpl.co.nz

Cell: +64 21 558 185

Skype: phosphateking

Media Release

As recently advised CRP Managing Director Chris Castle recently made a repeat visit to London to meet UK based potential investors.

The visit proved to be successful.

Meetings were held with a number of investment groups that identified with the project and who indicated their interest in investing by means of private placement, subject to Chatham Rock Phosphate establishing a secondary listing on the London AIM market.

Accordingly the CRP board has agreed to proceed with the AIM listing process, which is expected only two to three months to complete (as there is no associated public offering).

In order to maintain our existing momentum, including filing our marine consent application (EIA) in the next few weeks, a decision has also been made to make a very attractively priced rights issue to existing shareholders. Details of this offer will be announced to shareholders on 14 March and the rights will be both renounceable and, subject to NZX approval, tradeable on the NZAX market. Shareholders will also be entitled to apply for shortfall from the offer in addition to their entitlement. It is also intended to establish a panel of underwriters in order to ensure that the issue is fully subscribed.

CRP holds a strategic, multi-million tonne organic rock phosphate deposit uniquely positioned to access Asian and Australasian fertiliser markets. It was granted a 20-year mining licence in 2013 and has recently applied for new prospecting licences both east and west of its existing licence areas that could significantly increase the scope of resources. The company is currently finalising its Environmental Impact Assessment for its Marine Consent application.

Contact Chris Castle on +64 21 55 81 85 or chris@crpl.co.nz

25 February 2014

Chatham Rock Phosphate will be an exhibitor for the first time at the Prospectors and Developers Association of Canada convention, the world’s largest minerals investment and trade show being held in Toronto Canada next week.

“It is THE place where the mining industry talks turkey and does business,” CRP Managing Director Chris Castle said today.

He has attended the mining show for more than a decade but this year secured a prime booth position among the 600-plus in the investor exhibition area.

Government agency New Zealand Petroleum and Minerals is also operating a booth to promote New Zealand minerals projects and investment. Last year Mr Castle was the guest speaker at the New Zealand Government-hosted function.

Mr Castle will be hosting the CRP booth with Najib Moutia, CRP’s Canadian based Vice President Strategy, who is responsible for sales and marketing. He said the booth would provide a focus for people wanting to learn more about CRP’s innovative deep sea mining project. CRP’s technical partner Boskalis will also be displaying information on its capability.

PDAC has been running since 1932 and the annual convention now has more than 1000 exhibitors and 500 speakers. The 30,000 people who come from more than 120 different countries attend hundreds of presentations, courses, workshops and technical sessions during the four-day event.

CRP holds a strategic, multi-million tonne organic rock phosphate deposit uniquely positioned to access Asian and Australasian fertiliser markets. It was granted a 20-year mining licence in 2013 and has recently applied for new prospecting licences both east and west of its existing licence areas that could significantly increase the scope of resources. The company is currently finalising its Environmental Impact Assessment for its Marine Consent application.

Contact Chris Castle on +64 21 55 81 85 or chris@crpl.co.nz

To read the latest Chatham Rock Phosphate environmental fact sheet please - click here or on the image below.

Chatham Rock Phosphate Limited (NZX: CRP) advises that it has today issued 100,000 ordinary shares at an issue price of $0.31 per share and 50,000 CRPOB options to a qualified investor.

Chris Castle

Chief Executive

Email: chris@crpl.co.nz

To read the article online - click here

Full Text of Article:

Chatham Rock Phosphate managing director Chris Castle is confident of raising $6 million needed to help fund its marine consent application to mine the sea floor.

CRP was in December granted a 20-year mining permit to vacuum the sea floor for phosphate nodules, used in fertiliser, from the Chatham Rise.

Castle said he was now seeking $6m to help fund a marine consent application needed before mining could begin.

"The $6 million is chugging along quite happily on the back of the mining licence, which helped quite a lot. I am very confident about picking it up."

UK-based international corporate advisory firm Wimmer Financial has been appointed to assist in fundraising. "The sooner we can get that money in, the sooner we can file the environmental impact assessment."

Meanwhile, Niwa chief scientist fisheries, Rosemary Hurst said as far as was known, Chatham Rise was the main nursery ground for hoki. She said smaller hoki nursery grounds were off the coast of Southland and the West Coast. "But there are never anywhere near the numbers [of juvenile hoki] you get on the Chatham Rise . . . which is by far the most important."

Chatham Rise nursery ground could have 95 per cent of the 2-year olds [hoki], she said.

Castle said research, to be included in its environment assessment as part of its marine consent application to the Environment Protection Authority, showed ocean floor mining would have little or no effect on juvenile hoki.

"A worst-case scenario is that we might cause a quarter of 1 per cent of the juvenile hoki to swim elsewhere. And for the most part they are already swimming at greater depths than our activities on the crest of the Rise."

The total area of CRP's planned operation would be 450 sq km, or 30 sq km a year over the 15-year lifetime of the project. Castle said the operation area equated to less than one quarter of 1 per cent of the Rise's 190,000 sq km.

He also said the Chatham Rise should not be confused with the more sensitive hoki spawning grounds off the West Coast and in Cook Strait.

- © Fairfax NZ News

Dear Chatham Rock Phosphate shareholder,

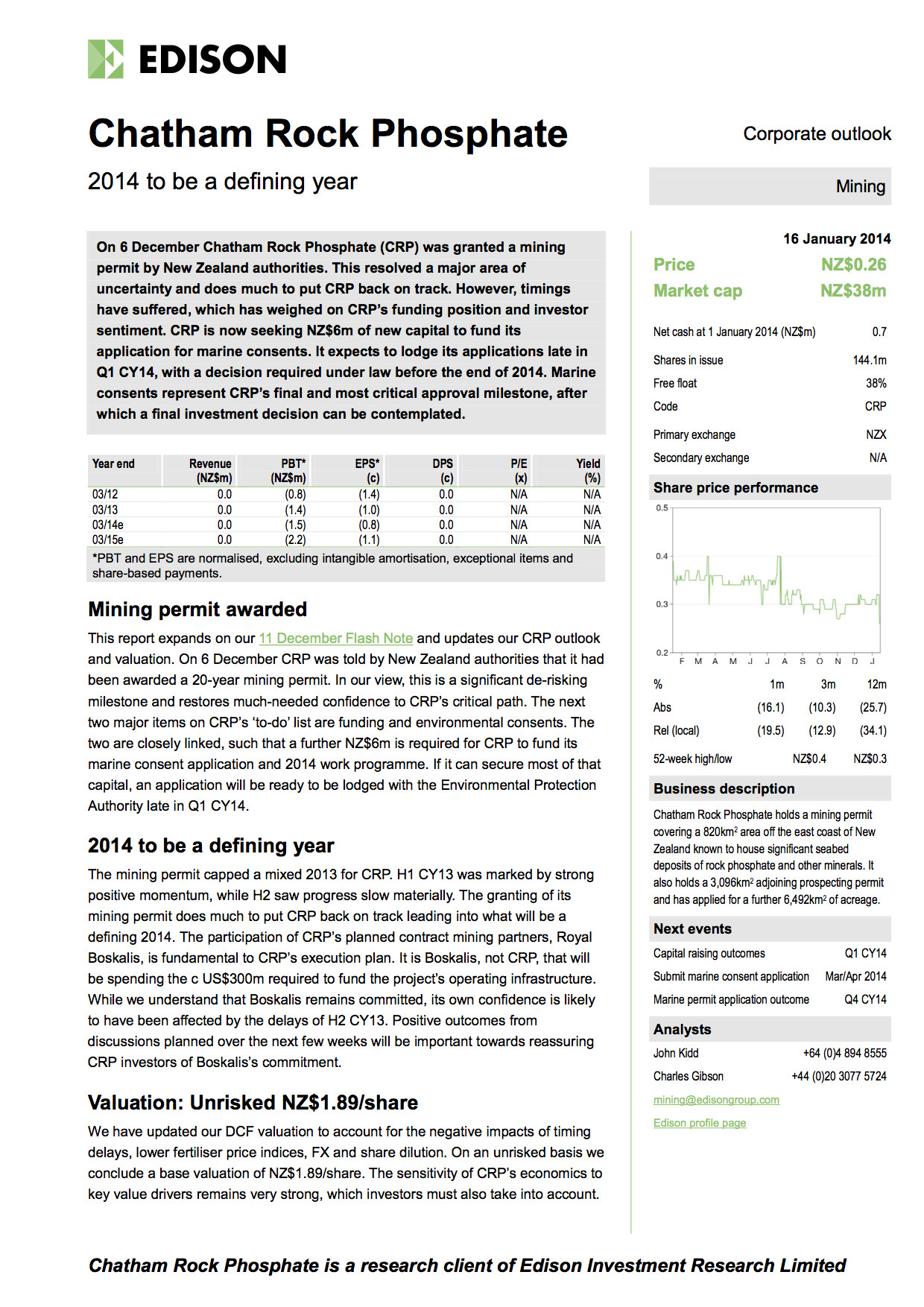

This report was released by Edison Investment Research in London last night and has just been filed with NZX.

Regards,

Chris Castle

Chief Executive Officer

Chatham Rock Phosphate Limited

Email: chris@crpl.co.nz

Cell: +64 21 558 185

Skype: phosphateking

Dear Chatham Rock Phosphate shareholder,

This announcement has just been released to NZX.

Best regards,

Chris Castle

CEO

Chatham Rock Phosphate Limited

Email: chris@crpl.co.nz

Cell: +64 21 558 185

Skype: phosphateking

14 January 2014

Allotment of Shares and Options

Chatham Rock Phosphate Limited (NZX: CRP) advises that it has today issued 672,217 ordinary shares at an issue price of $0.31 per share and 336,110 CRPOB options to qualified investors. This allotment has raised approximately $210,000 of new capital for CRP.

Chris Castle

Chief Executive

Email: chris@crpl.co.nz

For more information contact Chris Castle at: